9. Ocean Freight Comments

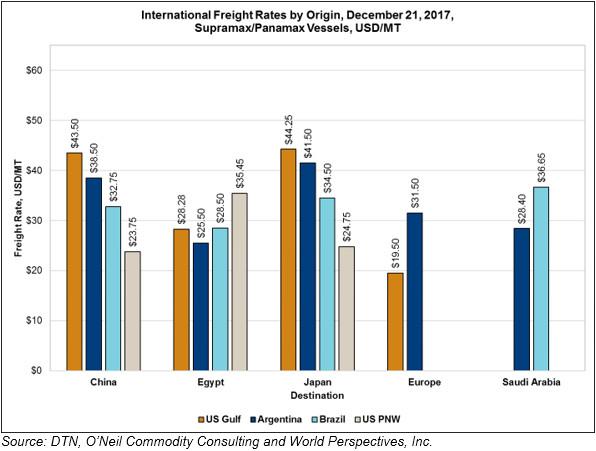

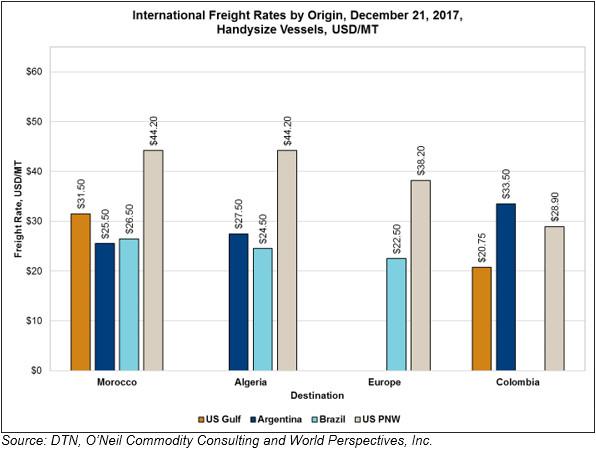

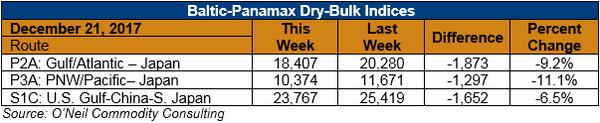

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: All the shipping news wires this week have the same verbiage: “Markets are slow and quiet.” This of course is code for “we are in holiday mode and the markets are soft.” The end of the year is always like this and the trick is to determine the market’s attitude once everyone returns from the holidays in January. Keep in mind, however, that the first quarter of any year is usually the slowest period and therefore the low end of the annual rate structure. I don’t expect to see anything different this year. Q1 2018 will likely be a bit softer than Q4 2017, but then we will probably start to see an uptick in rates as we move farther into the balance of the year. Higher freight rates will not harm traders but will directly impact market bids to farmers.

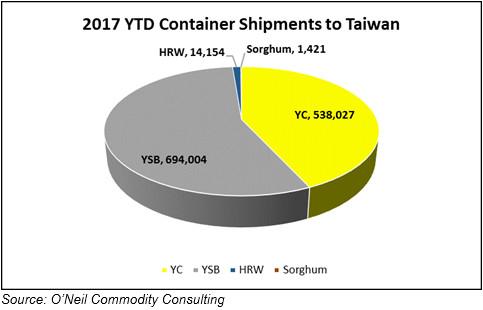

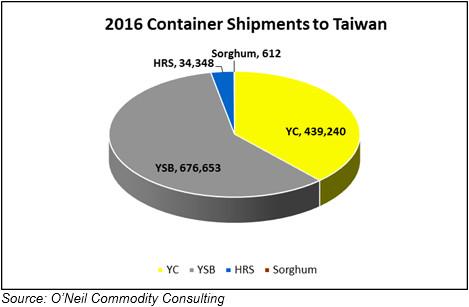

Given the higher dry-bulk rates verses containerized grain rates from the U.S. to Asia, I do expect to see a slight increase in the percentage of containerized grain sales in 2018.

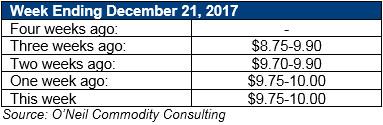

Below is a recent history of freight values for Capesize vessels of iron ore from Western Australia to China:

The charts below represent YTD 2017 versus 2016 annual totals for container shipments to Taiwan.