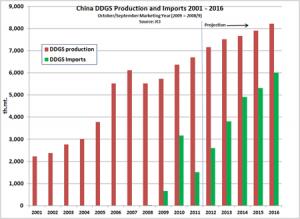

In a recent study commissioned by the U.S. Grains Council, the respected Chinese market analysis firm JCI reported that the new Five-Year Plan in China will restrict ethanol and dried distiller’s grains with solubles (DDGS) production growth to no more than 5 percent annually. Assuming an appropriate price for DDGS relative to corn and soybean meal, JCI projects that China’s imports of DDGS will grow steadily, reaching 6 million metric tons in 2016 and accounting for 42 percent of total DDGS use.

As this chart illustrates, Chinese ethanol/DDGS production followed a rapid growth trend until 2007. At that time, as growth in corn demand outstripped growth in production, the government of China placed limits on domestic ethanol production growth, leading to a dramatic increase of DDGS imports – almost all from the United States. As DDGS imports reached 3.1 million metric tons in 2009/10, China announced an anti-dumping investigation which led to a slow-down in DDGS exports last year. JCI does not foresee in its outlook that the investigation will result in significant barriers to U.S. DDGS exports to China in the future.