Staff and members of the U.S. Grains Council (USGC) like to say the sun never sets on the Council’s work around the world to promote U.S. feed grains and co-products.

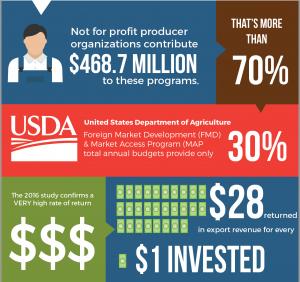

That work is made possible by member support and the strong public-private partnership created by two long-term government initiatives – the Market Access Program (MAP) and Foreign Market Development (FMD) program – funded through the farm bill.

“If you are in a segment of agriculture that is dependent on exports, and most every sector is, these are two largest export promotion programs that we have,” said Max Armstrong, host of Farm Progress America in the September broadcast. “And it is a public-private partnership that makes them happen.”

The importance of these two efforts was highlighted recently in media stories by the policy- and politics-focused Politico and the ag-focused Farm Progress America. Both stories explained how the programs combine private investments with funding from the U.S. Department of Agriculture’s Foreign Agricultural Service (USDA’s FAS) to establish long-term presence in world markets, promote U.S. agricultural products and bring groups of prospective buyers to the United States.

MAP and FMD have successful track records in generating a high return on investment for both farmer and federal dollars. According to a cost-benefit analysis conducted by Informa Economics in 2016, the value of U.S. agricultural exports increased $24 for every $1 invested between 2002 and 2014. Additionally, MAP and FMD account for 15 percent of revenue generated between 1977 and 2014 through U.S. agricultural exports – $309 billion in total.

In the Politico article, Kim Atkins, USGC vice president and chief operating officer, highlighted Bangladesh as an example of this ROI, telling the outlet that a Council investment of $150,000 in export development work using MAP funds resulted $17 million in purchases of U.S. corn in 2016.

Atkins also emphasized that the MAP and FMD programs are important not only to building markets, but also to maintaining U.S. market share as worldwide competition increases.

“Our biggest competitors, like Brazil and Argentina, aren’t sitting around waiting for the U.S. to start its own bilateral agreements,” Atkins said. “And the 11 other countries in the TPP (Trans-Pacific Partnership) are discussing moving forward without the U.S., so these programs have become even more important to remain competitive against other exporters.”

Politico Pros can read the full article here or listen to the Farm Progress America story here.