The 2016/2017 marketing year set a new record for exports of feed grain in all forms and the number of world buyers for coarse grains and co-products diversified, evidence of the importance of the Council’s work to both identify short-term market opportunities and build long-term demand.

Overall, these exports reflect the shifting dynamics in world markets and global trade policies as well as the current price environment. The diversification in world buyers reflects increased interest from traditional customers, trade policy troubles in select markets, and new buyers emerging from developing countries.

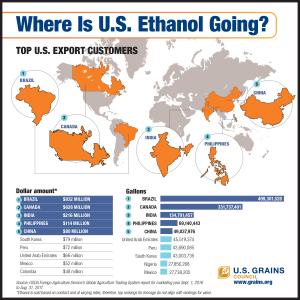

A series of infographics from the U.S. Grains Council (UGSC) outlines the top markets for corn, sorghum, barley, ethanol and distiller’s dried grains with solubles (DDGS) in 2016/2017. These infographics provide another visual demonstration of the puzzle of demand for U.S. farmers and the important role of market development efforts.

Countries purchasing U.S. ethanol in 2016/2017: 76.

Global markets are responding to the Council’s efforts to expand U.S. ethanol use worldwide by demonstrating it to be a reliable and affordable source of octane. U.S. ethanol exports set a record in 2016/2017 at 1.37 billion gallons (488 million bushels in corn equivalent) a 34 percent increase year-over-year, exported to 76 countries. Brazil was the year’s top buyer, setting a new export record with 499 million gallons (178 million bushels in corn equivalent) in purchases.

Countries purchasing U.S. corn in 2016/2017: 72.

In the 2016/2017 marketing year (September-August), U.S. corn exports realized substantial gains with the most exports since 2007/2008, 58.1 million metric tons (2.29 billion bushels) purchased by 72 countries. Mexico maintained its rank as the largest buyer of U.S. corn, and for the fourth year in a row, set a new record at 13.9 million tons (547 million bushels).

Countries purchasing U.S. barley in 2016/2017: 64.

Exports of U.S. barley were shipped to 64 countries in 2016/2017 (June-May), including exports destined for the Japanese food barley market as well as brewers in Mexico. Mexico was the largest buyer of U.S. barley at more than 358,000 tons (16.4 million bushels).

Countries purchasing U.S. DDGS in 2016/2017: 54

The Council’s efforts to market DDGS following trade disruptions and help end-users determine how best to incorporate it into their rations, combined with one of the lowest per-unit-of-protein costs compared to other feed ingredients in the market, resulted in significant sales diversification and exports to 54 countries. Mexico was also the largest buyer of U.S. DDGS in the last marketing year, purchasing 2.06 million tons.

Countries purchasing U.S. sorghum in 2016/2017: 22.

A decline in U.S. production led to a decline in sorghum exports in 2016/2017. However, thanks to continued purchasing by 22 countries, U.S. sorghum exports totaled 6.04 million tons (238 million bushels), still greater than the prior five-year average of 5.26 million tons (207 million bushels). China remained the largest market for U.S. sorghum with 4.8 million tons (189 million bushels) in purchases.

Find the full resolution size of these charts as well as other infographic resources here.