India’s new tax structures for 1,200 goods and 500 services, in place as of July 1, are intended to simplify the country’s complex and hard-to-administer tax code but could have mixed effects on imports of U.S. ethanol.

The new goods and services tax plan, known as a GST plan, creates five tax structures ranging from 0 to 28 percent. The GST Council applied the second highest bracket – 18 percent – to ethanol for the chemical manufacturing industry (ethyl alcohol). The previous structure assessed ethyl alcohol with a complex set of taxes – 12.5 percent central excise, 2.5 percent import tariff, plus a variable state-by-state value-added tax of typically 5 percent and minus offsets from refunds or credits.

Under the new tax structure, the central excise tax and state-by-state value-added tariffs are eliminated and lumped into the overarching GST structure.

Thus, ethanol will be levied at a flat 18 percent, and potable alcohol will continue to be exempt from the GST structure as a state-by-state taxation issue not under the purview of the federal government.

Denatured ethyl alcohol for industrial use will also face a 2.5 percent import tariff under the new structure, following a decrease in the duty to 5 percent from 7.5 percent in 2014. Ethanol for blending in fuel and potable ethanol, however, falls under a completely different taxation structure.

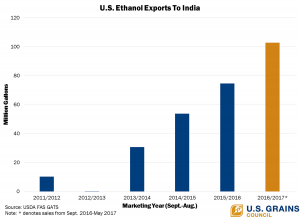

Overall, Indian ethanol importers view the new GST structure as fairly tax neutral at a time when the Indian government has ramped up a commitment for indigenously-supplied fuel grade ethanol, creating a vacuum for the more traditional demand pull from the chemical sector. Ethyl alcohol is a key component for producing amines for dyes for the textile and garment industry as well as agrochemicals. As a result, India recently eclipsed Canada as the second largest importer of U.S. ethanol, purchasing more than 102 million gallons thus far this marketing year (September 2016-May 2017).

The Council continues to engage with the Indian government and industries to determine how best to meet the needs of this growing and shifting market, especially as the country’s tax reform process continues.

Learn more about the Council’s work in India here.