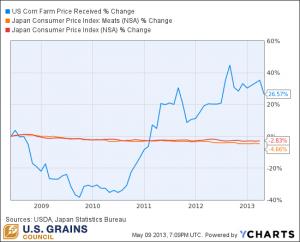

It’s an undeniable fact that corn represents a large proportion of our foodstuffs. Everything from meat to soda to plastic contains some variety of corn products. Of course, the product that gets the most media attention is gasohol, otherwise known as ethanol. Even with the world’s largest ethanol industry, the United States will over time bounce back from 2013’s drought-depressed levels to remain the world’s leading corn exporter. Therefore, internationally, ethanol is often made the scapegoat for the rising cost of animal production, which contributes to the rising consumer price index (CPI). But as long-time students of the matter know, the data tell a different story. Japan is the United States’ largest importer of corn and this week’s U.S. Grains Council Chart of the Week graphs the price of corn versus the Japanese CPI and more selectively, the “meat CPI.”

Japan has had a longstanding economic policy of deflationary practices. Crippled with the highest standards of living and most expensive costs in the world, Japanese politicians made it their mission to lessen the economic burden of living and doing business in Japan. However, what resulted is a stagnant economy and an opening for economic partner and rival, China, to leapfrog Japan as for the world’s second largest GDP. Nevertheless, in this week’s chart, one can clearly see the impacts (or lack thereof) of high corn prices on Japanese meat prices (and therefore overall Japanese CPI).

Japan’s situation may soon change. Many analysts have credited newly elected (for the second time) Prime Minister Sinzo Abe with breaking down the old standing rule of economic deflation with a promise of 2 percent inflation with U.S. style quantitive easing to help out Japanese stocks. The Nikkei 225 Index has responded very favorably, with a marked 63 percent increase in the time since Abe was elected. The real question, however, remains. How will Japanese food and meat prices respond over the long run with a red hot, inflationary economy and projected lower corn prices?