A U.S. barley industry bumper sticker proudly proclaims: “No barley, no beer.” But without the North American Free Trade Agreement (NAFTA), U.S. barley producers would miss out on their top export destination – the Mexican beer industry.

“NAFTA played a critical role in developing the interdependent successes of the U.S. barley and Mexican brewing industries,” said Kimberly Atkins, U.S. Grains Council (USGC) vice president and chief operating officer. “Three decades of USGC work and the duty-free access provided by NAFTA have positioned U.S. barley as the top resource for a strong and growing Mexican beer market.”

To emphasize the importance of NAFTA to both U.S. barley producers and Mexican brewers, the Council, the Montana Wheat & Barley Committee and the North Dakota Barley Council organized a Mexican brewing industry team to travel to North Dakota and Montana this week. The team met with U.S. barley farmers and government officials to discuss how the preferential trading terms in NAFTA have cultivated the increasing integration of supply and production chains on both sides of the border.

“The relationships between Mexican brewers and U.S. barley producers have developed into some of the strongest connections I have seen between farmers and end users,” said Heidi Bringenberg, USGC assistant director in Mexico, who accompanied the team. “Sales and success – from both sides – communicate a powerful story to share about why barley farmers and the Mexican brewing industry want to continue the healthy working relationship established over many decades.”

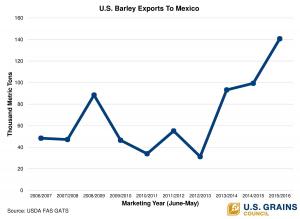

Mexico purchased more than 680,000 metric tons (31.2 million bushels) of U.S. barley valued at $220 million over the last 10 marketing years, driven by the Mexican brewing industry. The 2015/2016 marketing year exports generated $48 million in additional economic activity throughout the U.S. grain supply chain.

A good portion of the beer brewed with those imports later travels back across the border as imported beer, including recognizable brands like Dos Equis and Modelo. In fact, the U.S. Department of Commerce reported that seven out of 10 beers imported by the United States originated in Mexico.

The trading terms laid out in NAFTA help make this symbiotic trading relationship possible. Prior to NAFTA, Mexico set base tariffs for barley and malt at 128 percent and 175 percent, respectively. When it came into force, the agreement provided immediate duty-free access for 120,000 tons of U.S. barley into Mexico, with remaining tariffs eliminated over the first 10 years of the agreement. Now, U.S. barley and malt enter Mexico duty-free, making them an attractive option for beer makers who depend on malt and malt barley imports due to the lack of malting capacity in Mexico.

However, competing supplies from Europe that have still been subject to this quota and tariff system will gain duty-free access this year, making NAFTA’s duty-free access not only a selling point, but a necessity for U.S. barley and malt to remain competitive for Mexico’s large industry brewing sector and the exponentially-growing craft brewing sector.

“The brewing industry in Mexico is growing strong as all of the breweries are making substantial investments in new brewing, malting and bottle manufacturing plants,” Atkins said. “These investments represent additional demand and opportunities to strengthen existing supply relationships with U.S. producers and exporters, if the duty-free trading relationship established under NAFTA continues unhindered.”

“We are proud to bring our Mexican guests and customers to the heart of barley country. The story of how these markets succeed on both sides of the border thanks to NAFTA is important for all of us to share.”

Listen to Atkins talk more about the Mexican brewing industry team here.