Canada – the host of the just-concluded third round of talks on the North American Free Trade Agreement (NAFTA) – is a top trading partner for U.S. feed grains and co-products like ethanol and distiller’s dried grains with solubles (DDGS) thanks to geography and strong trade policy.

Canada – the host of the just-concluded third round of talks on the North American Free Trade Agreement (NAFTA) – is a top trading partner for U.S. feed grains and co-products like ethanol and distiller’s dried grains with solubles (DDGS) thanks to geography and strong trade policy.

“The Council has built trusted relationships supported by the strong policies in NAFTA,” said Floyd Gaibler, USGC director of trade policy and biotechnology. “The Canadian market is critical to our industry, and this trade agreement provided the foundation for growth across the sectors we represent.”

Economically and technologically, Canada and the United States developed in parallel across the world’s longest international border. Following its implementation, NAFTA’s terms dramatically increased trade and economic integration between the two countries, with Canadian livestock producers able to access U.S. feed grains and co-products competitively due to close proximity to northern U.S. ethanol plants as well as the efficiency of transporting by rail or truck.

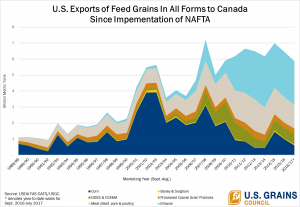

Since NAFTA entered into force in 1994, exports of corn in all forms to Canada have increased 2.5 times, including a six-fold increase in corn exports, an almost 10-fold increase for DDGS and corn gluten feed/meal and a 90-fold increase for ethanol.

The Council is working to capture even more Canadian demand for feed ingredients by emphasizing the nutritional, economic and logistical advantages of U.S. DDGS. Canada currently ranks as the seventh largest market for U.S. DDGS this marketing year with more than 607,000 tons of U.S. DDGS purchased (Sept. 2016-July 2017), a 20 percent increase year-over-year.

And Canada imports close to 20 percent of its domestic fuel ethanol, nearly all of it from the United States. As a result, Canada has consistently ranked as a top importer of U.S. ethanol, coming in as the second largest buyer in 2016/2017. U.S. ethanol imports of 301 million gallons (2.73 million tons or 107.5 million bushels in corn equivalent) thus far this marketing year are up eight percent compared to the same period the year prior.

Close geographic proximity and preferential trading terms also allow the United States to help fill shortfalls in Canadian domestic production. For example, while Canada is not historically a large barley importer, U.S. barley imports have increased this year to 66,6000 metric tons (3.06 million bushels) due to a low crop production year in western Canada.

The Council’s primary goal in the NAFTA talks is to preserve the market access that makes this trade possible. The most recent round of negotiations made progress on consolidating text proposals, narrowing gaps and agreeing to elements of the negotiating text on non-tariff issues including sanitary-phytosanitary measures and broader regulatory cooperation.

“The completed third round of negotiations in Ottawa continued to reflect a high level of ambition and urgency to conclude these negotiations by the end of the year or early 2018,” Gaibler said. “Engagement with our trading partners has intensified with significant challenges on contentious issues still to be formally discussed in upcoming rounds.”

“We look forward to continuing to participate in this process and working to create a new platform for growth and integration of our regional feed and fuel industries that provides long-term certainty and confidence to two of our best trading partners.”

Learn more about the Council’s work in Canada here.