The partial federal government shutdown that began Oct. 1 has reverberated through global equity, currency and commodity markets. The lack of official data and statistics has hog buyers rethinking the way they pay producers, grain traders wondering about crop production and equity traders wondering about official jobs figures. While budget negotiations may stretch into another debt crisis on Oct. 17, with the possibility of a government default, one thing still remains steadfast and solid—the U.S. commitment to exports.

Foreign market reaction to the shutdown remains cautiously mixed. The lapse in accustomed points of contact and data reports is unsettling to some buyers, but trade continues. Marri Carrow, USGC director of communications, is currently overseas telling major Asian markets that the United States is emphatically “open for business,” and Kevin Roepke, USGC manager of global trade, is encouraging importers to actively manage their risk to mitigate the increased uncertainty.

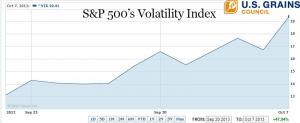

“The Standard & Poor’s 500 volatility index (VIX) is up almost 50 percent in the past three weeks and down 15 percent today alone,” Roepke said. “Without the core government reports, the market lacks a clear direction and is vulnerable to various headline swings—especially if and when the government fully reopens. Nevertheless, even after a shutdown, you won’t find a country, or a government as dedicated to exports as the United States.”

A great example of this is the United States keeping export inspectors on the job. DTN Political Correspondent Jerry Hagstrom reported that despite widespread furloughs, federal grain inspectors would report to work to ensure America’s ability to satisfy global grain demand. Even though much of the USDA website remains offline, traders were also relieved to find out that federal grain inspection reports would be released to the public.

In another act of export camaraderie, the Federal Grain Inspection Service (FGIS) issued a new directive, prior to shutdown, regarding inspections of containers. The regulation, which can be found here helps clarify and level the playing field to “facilitate the marketing of bulk U.S. grain exported by containers” to all destinations, except Mexico and Canada. In sum, the directive states:

- Applicants may request composite sample analysis or average grade/average composite analysis of export containers provided that the load order represents these provisions included in the export sales contract.

- Composite samples will be limited to a maximum of 20 containers.

- Inspection/Weighing of containers included in a composite must also be loaded in a reasonably continuous operation, with breaks in loading not to exceed 88 hours, sometimes referred to in the industry as the “88 hour rule”

“This is an initiative the Council has been tracking for a while now,” Roepke commented. “The partial shutdown is a nuisance, but a core of essential federal employees are on the job, and we are finding ways to keep trade flowing.”