Each year, Israel imports between 2.4 and 2.5 million metric tons of feed grains. The product mix of corn, feed wheat, barley, sorghum, oats and rye changes year-to-year, depending on prices for delivery to Israeli ports from various points of origin in the region.

In recent years, Ukraine and Russia – among other Black Sea sources – have dominated the Israeli market for corn, feed wheat and barley due to proximity and resulting freight advantage over the United States and South America.

“U.S. market share of this grain market of roughly eight million people has seen a decline lately,” says Cary Sifferath, U.S. Grains Council regional director for Middle East and Africa. “But we’re seeing it start to return.”

Last week Sifferath traveled to Israel to meet with key feed grain importers, present findings from the 2013/2014 Corn Export Cargo Quality Report and get a feel for the potential of additional U.S. sales to the country.

“Just recently, three vessels of U.S. corn were loaded for May shipment to Israel,” says Sifferath. “Plus there was a recent tender by one major importer for July corn shipments and the United States will meet that order.”

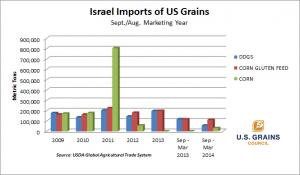

In the marketing year that began Sept. 1, Israel has imported 205,000 tons (8 million bushels) of U.S. corn for May and June shipment. Sifferath is projecting another 64,000 tons (2.5 million bushels) for July shipment.

Israel remains a steady, long-time customer of U.S. corn co-products including distiller’s dried grain solubles (DDGS) and corn gluten feed (CGF). The country’s dairy sector is a heavy user of DDGS and CGF with some DDGS earmarked for poultry consumption.

“We expect to see Israel continue to import U.S. DDGS and CGF,” says Sifferath. “There’s a possibility of increase in both due to shortages of forage and fiber-based feed ingredients.”