As harvest begins in South America, the world anxiously watches. Many end users are anticipating large Argentine and Brazilian crops following one of the worst droughts in recent memory in the United States. However, the dynamic of determining what Argentine farmers plant isn’t as cut and dried as it is in America.

According to DTN’s South America correspondent, Alastair Stewart, the margins and return on investment would seem to provide a strong incentive to increase corn plantings, but Argentine farmers chose to ignore these data and increase soybean acres instead.

According to Agripac, a South American consultancy service, the first crop margin in Argentina for growing corn was an astonishing 36% higher than that of soybeans. Stewart contends this anomaly is caused by Argentina’s increasing government intervention. The government manipulates corn exports via quotas, whereas soybeans can trade freely. That means, said Stewart, “that farmers can never be sure of getting full market price.”

“It’s really a currency play,” noted Kevin Roepke, manager of global trade for the U.S. Grains Council. “Argentina is plagued with 20-30% inflation and Argentine farmers want a currency safe haven. In some aspects, it mimics why many investors have stockpiled gold around the world—growing soybeans is the safe play because there will always be a market for them.”

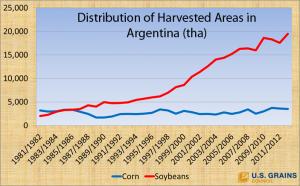

Argentina has seen corn area harvested remain relatively flat over a 30 year time frame—up only 13.5%. Compare that to the explosive growth of Argentine soybean acres—up almost nine-fold over the same time period, according to USDA data. “It’s really been a remarkable transformation,” commented Roepke. “It started in the mid-80s when Argentine farmers first started to harvest more soy acres than corn. Since then, it’s been an explosion.”

The cost to produce soybeans in Argentina is the envy of the world. Stewart claims the cost of fertilizer and chemicals to produce an acre of soybeans in northern Buenos Airies is a resoundingly low $53 dollars per acre. Compare that to neighboring Brazil, where the cost stands at $189. Land rental is also significantly cheaper in Argentina, going for around $160 per acre. By comparison, Iowa State University’s Ag Decision Maker pegs Iowa costs for herbicide tolerant soybeans following corn at $66 for chemicals and $276 per acre for cash rent.