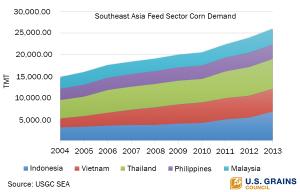

This U.S. Grains Council’s chart of note illustrates five Southeast Asian countries’ growing demand for corn as livestock feed.

In 2004, the region’s feed sector corn demand was 15 million metric tons. Less than a decade later, that demand has grown to more than 25 million tons, a 66.7 percent increase. This rise in demand is amid a decrease in the availability of local corn supplies, which results in a higher reliance on imported coarse grains and co-products.

Right now, the region fills that demand with imports from as many as 16 other origins, with India, Argentina, Brazil, the United States and Thailand accounting for the majority of total corn trade in Southeast Asia. The region’s corn imports in 2013 hit an all-time-record of 8.5 million tons (334.6 million bushels), registering a 13 percent growth rate year-on-year and 60 percent growth rate in the past five years. While U.S. corn imports to the region were just 51,200 tons (2 million bushels) in 2013, regional imports of U.S. corn co-products (both distiller’s dried grains with solubles, also known as DDGS, and corn gluten meal) were 1.4 million tons.

DDGS has proven to be a valuable source of energy, amino acids and phosphorus for swine, poultry and aquaculture diets, the three main animal sectors in the region. While the region boasts a wide variety of locally-produced feed ingredients, there is practically no competition for DDGS in its mid-protein category. The Council estimates that demand for DDGS in South and Southeast Asia could double to 2.3 million tons when these three sectors reach their full potential.

The Council has a long history of demand-building programs in Southeast Asia and will continue to monitor the region for new developments and opportunities for U.S. coarse grains and co-products.