1. Chicago Board of Trade Market News

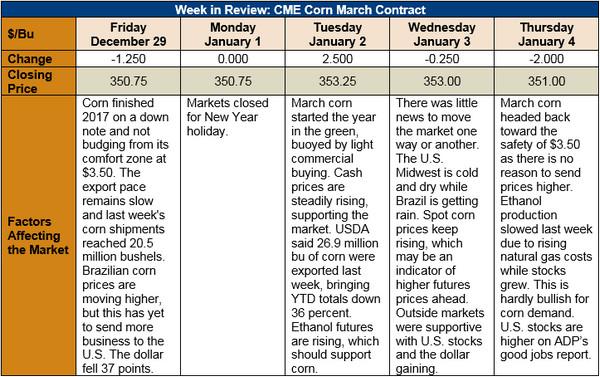

Outlook: March corn refuses to leave the safety of its narrow range around $3.50/bushel. Two holiday-shortened trading weeks in a row, combined with little fresh news, have left the contract decidedly range bound. The holidays created a lack of fundamental news and next week’s January WASDE isn’t likely to show major changes to the U.S. corn balance sheet. Until some new information is gathered, corn seems relegated to its current sideways pattern.

Brazilian corn prices have been rising steadily in the past few weeks, giving U.S. exporters more opportunities to increase sales. Today’s prices show FOB NOLA corn as cheaper than Paranagua, Brazil and Argentina Upriver FOB offers, thought slightly higher than Santos, Brazil paper prices. The USDA will release its weekly Export Sales report on Friday this week, one day later than usual due to the New Year’s holiday. Monday’s Export Inspections report from the USDA showed 26.9 million bushels exported, a bearish amount that keeps marketing year-to-date totals down 38 percent from last year. The USDA’s balance sheet currently projects a 16 percent reduction in exports, meaning exporters will have to get aggressive in 2018 to meet the agency’s projection.

Weekly ethanol production fell 5 percent this week as the cold weather across the U.S. boosts natural gas costs and ethanol production costs. Ethanol stocks increased 3 percent as the cold weather limits driving and gasoline consumption. Ethanol has been a bright spot for corn demand this year and this week’s production decrease is likely just a blip on the radar.

From a technical standpoint, March corn is heading sideways with neither upward nor downward momentum. The 40-day moving average has been likened to a “line in the sand” by some traders, with corn unwilling to close above this chart point. Still, cash corn prices are rising as is basis, a sign of commercial buying and of possible futures price increases ahead. Funds still hold a large short position in corn, and should something spark a covering of this position, the market could pop higher quickly. But, until that happens, March corn futures are hovering near $3.50 until further notice.