1. Chicago Board of Trade Market News

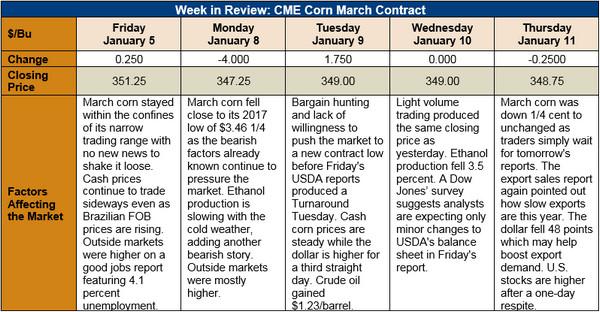

Outlook: March corn is trading sideways in a comfortable range near $3.50, waiting for tomorrow’s USDA reports. Tomorrow’s reports, however, aren’t expected to produce major changes to the U.S. or world balance sheets. If that is the case, corn will be relegated to continue its slow, sideways trade until U.S. planting prospects are better determined.

USDA’s Export Sales report featured 676,300 MT of gross sales with 889,800 MT of exports. The export volume was nearly double the weekly pace needed to meet USDA’s export projections, but after months of poor export volumes, this was a drop in the bucket. Year-to-date bookings (exports plus unshipped sales) are down 25 percent but exports are off 36 percent. Rising Brazilian corn prices could give U.S. exporters an opportunity, but steady U.S. cash prices do not reflect this dynamic yet.

Ethanol production fell for a second straight week in Wednesday’s EIA report, dropping 3.5 percent from the prior week and coming in under 1,000 million barrels/day for the first time in 12 weeks. Ethanol stocks were steady even as gasoline consumption increased 2 percent. Blender margins remain solid which will continue to support the ethanol markets. Additionally, livestock feeding efficiency will be lower with the cold weather, boosting DDGS demand. Ethanol has been a bright spot for the corn market this year and is likely to continue this role once warmer weather allows production to bounce back.

Tomorrow’s USDA report could feature an increase in U.S. sorghum acres. Farmers planted 5.7 million acres to sorghum last year, and some industry experts are calling for increases this year. Sorghum prices have been rising in the U.S. (FOB NOLA sorghum priced at $192/MT versus $167.50/MT this time last year) and, with the decline of wheat area, farmers may plant more sorghum in 2018. Some analysts are hearing reports of sorghum seed sales being stronger than expected.

From a technical perspective, March corn is range-bound and headed sideways now. It will be all about the fundamentals in tomorrow’s USDA report. Looking ahead, there’s simply not a whole lot that the USDA can use to surprise the market. A sudden change in foreign production or a larger-than-expected change to U.S. December 1 stocks are seemingly the most likely possibilities. Historically, however, the January WASDE is not a market-shocking report and, given this, corn is likely to begin next week’s trade right around $3.50/bushel.