CHICAGO BOARD OF TRADE MARKET NEWS

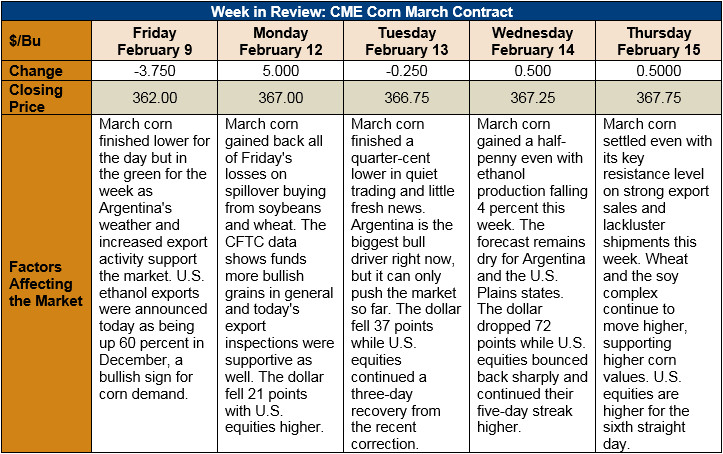

Outlook: The rally in March corn futures has stalled somewhat since last week, but the market’s ability to maintain current prices is a sign of strength as well. The ongoing drought in Argentina is the biggest factor directly impacting the corn market, but dryness across the southern U.S. is also concerning. Additionally, the corn market has benefited from spillover buying in the wheat and soybean markets, which are arguably more impacted by the Argentina/southern U.S. weather dynamics than corn.

This week’s Export Sales report from USDA featured large 2017/18 corn sales (2.06 MMT of gross sales and 1.974 MMT net sales) but a smaller volume exported. Exports reached 864,500 MT this week, keeping YTD export totals down 14 percent from this same time last year. With the U.S. dollar index’s return below 89, exports should pick up in the near-term – especially as FOB NOLA corn remains the most competitive globally.

Weekly ethanol production fell 4 percent this week with ethanol stocks falling 2 percent but remaining above year-ago levels. Gasoline consumption was down 1 percent but should pick up through the spring with the spring/summer driving season. Ethanol production margins are creeping back into the green with higher DDGS valuations and rising ethanol values. This should keep corn moving into ethanol plants this spring and aid in corn demand.

From a technical perspective, March corn is trending higher but has hit significant resistance at $3.68. The continuing drought in Argentina and spillover buying from wheat and soybeans are losing their power to push corn higher and fresh, bullish news for the corn market will be required to break above this resistance level. CFTC’s latest data shows funds have already pared back a substantial segment of their massive short position, limiting one reason for corn prices to move higher. The world still has plenty of corn and for now, it’s a game of U.S. exports and anticipated U.S. plantings influencing the futures market.