The election of Andrés Manuel López Obrador, a left-of-center populist, as Mexico’s next president on July 1 will add new elements to the already-complex U.S.-Mexico trading relationship, negotiations for a revised North American Free Trade Agreement (NAFTA) and the global grains marketplace.

In the midst of this political and market ambiguity, the U.S. Grains Council (USGC) remains committed to defending and maintaining the long-standing partnership with top customers in Mexico.

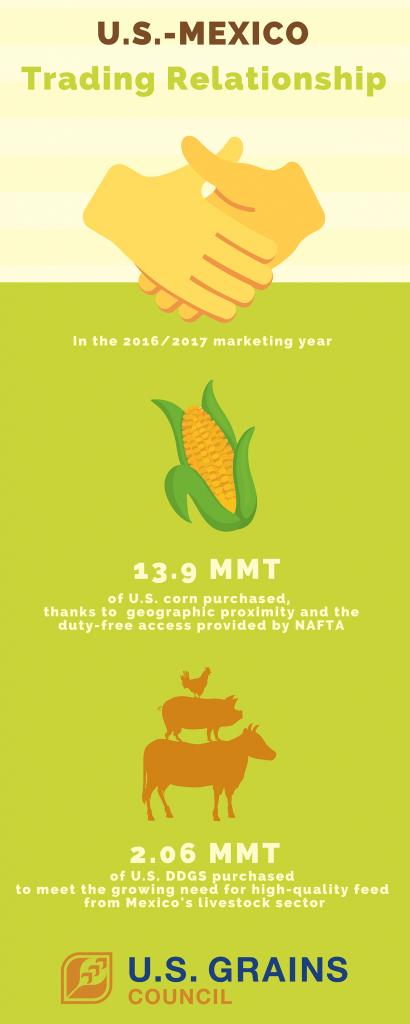

“Mexico is the most important global market for U.S. grains and related products, supported by the most valuable trade agreement in place for U.S. grain producers and exporters – NAFTA,” said Tom Sleight, USGC president and chief executive officer. “Last year, Mexico was the top buyer for U.S. corn and distiller’s dried grains with solubles (DDGS), a strong market for U.S. sorghum and barley and an emerging market for U.S. ethanol.”

U.S. exports to Mexico benefit from geographic proximity and the duty-free access provided by NAFTA. Mexico set a new record as the largest export market for U.S. corn in 2016/2017, purchasing 13.9 million metric tons (547.2 million bushels) worth $2.5 billion. Mexico was also the top market for U.S. DDGS, importing 2.06 million tons in 2016/2017. Since NAFTA entered into force, Mexican imports of these two commodities have increased 845 percent and 945 percent, respectively.

Mexico continues to rank as the top U.S. corn market in the 2017/2018 marketing year (September 2017-April 2018), increasing purchases by eight percent from last year despite ongoing NAFTA talks. Mexico is also the number one buyer of U.S. DDGS with purchases of 1.43 million tons thus far to meet the need for high-quality feed from the country’s livestock sector.

The Council has maintained an office in Mexico City for more than 35 years, working closely with Mexican traders, feed industry members and livestock producers to develop mutually-beneficial trading relationships and integrated supply chains. Programs throughout the country are continuing to seek additional untapped demand, including from the country’s rapidly-growing livestock sector, large industrial and small craft brewers and an evolving energy sector looking closely at biofuels.

The Council’s team in Mexico will continue long-term market development work and new outreach to incoming agricultural and other agency leaders as the government prepares for López Obrador to assume the presidency later in 2018. The proposed minister of agriculture, Victor Villalobos, is a plant scientist and former official at the Mexican Ministry of Agriculture, Livestock, Rural Development, Fisheries and Food, familiar to U.S. agriculture organizations.

“The Mexican election was historic and also injects new elements into the already complicated U.S.-Mexico trading relationship and global grain markets,” Sleight said. “While a cause for vigilance, it is also the best reason to continue our strong engagement in Mexico, talking with customers, working with local government officials and communicating with leaders there and back here in the United States to emphasize how critical this relationship is to our success as an industry.”

“As this new uncertainty enters the marketplace and NAFTA negotiations, our staff in Washington and Mexico City will continue working closely with all stakeholders to ensure – as best we can – our trade remains open, fair and beneficial to all parties.”

Read more about the Council’s work in Mexico here.

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.