Data from the U.S. Department of Agriculture’s (USDA’s) Economic Research Service (ERS) indicates U.S. ethanol production during the 2014/2015 marketing year reached a record volume of 14.7 billion gallons (55 billion liters), which is up 3.9 percent from the previous year. Exports for the same time period were 872 million gallons (3.3 billion liters).

Government mandates, which identify a certain amount of ethanol to be blended with gasoline, are making a big impact on global ethanol demand. In many countries, blend mandates function as targets rather than as requirements. USDA estimates 84 percent of U.S. ethanol exports in 2014 went to countries with mandates in place, a trend that continued in 2015 and will likely remain in 2016.

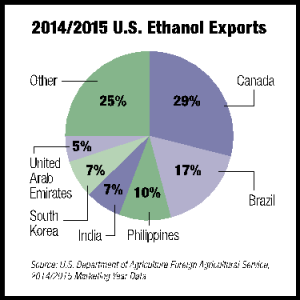

The Philippines, India, Peru and South Korea now join Canada, Brazil and China as top U.S. ethanol importers, while exports to a previous top purchaser, the European Union, have significantly decreased, shifting the overall diversification of the U.S. ethanol markets. On an annual basis, Canada remains the top importer of U.S. ethanol, driven by national blend mandates in the country and convenient access to U.S. production.

Exports to Brazil have changed in recent years due to fluctuations in the price of their main ethanol feedstock, sugar and supply availability in certain regions of Brazil throughout the year. It remains the number two export market for U.S. ethanol, although the pace has slowed so far this year.

USDA export trade data for 2014/2015 indicates strong growth in U.S. ethanol exports to the Philippines and India. These countries have blend mandates in place and represent the third- and fourth-largest export markets, respectively.

Domestic ethanol production in the Philippines (using sugar cane and molasses as feedstocks) has been unable to meet their 10 percent blend mandate, resulting in the need for imports. The 5 percent blend mandate in India has not been met due to insufficient domestic fuel ethanol supplies. The country has a goal of 20 percent blending by 2017, making increased ethanol imports a necessity there to reach the blending target.

The United Arab Emirates and Oman both showed strong growth since early in 2014. These are largely discretionary blending markets, meaning ethanol is used there above a mandated rate or based on favorable ethanol prices. Exports are driven by the relative price of ethanol and gasoline rather than an established blend mandate. As the price of crude oil decreased worldwide in 2015, estimates of U.S. ethanol exports to the region have shifted between market participants, and the region remains one of our largest export markets.

Additional markets contributing to the U.S. ethanol export diversity are South Korea, Tunisia, Peru and Mexico. South Korea imported 57.3 million gallons (217 million liters) of U.S. ethanol in the 2014/2015 marketing year, while Tunisia imported 44 million gallons (167 million liters). Peru imported 18 million gallons (68 million liters), and is on track to double that level this year. Mexico’s total for the same time period was 33.4 million gallons (126 million liters).