Chicago Board of Trade Market News

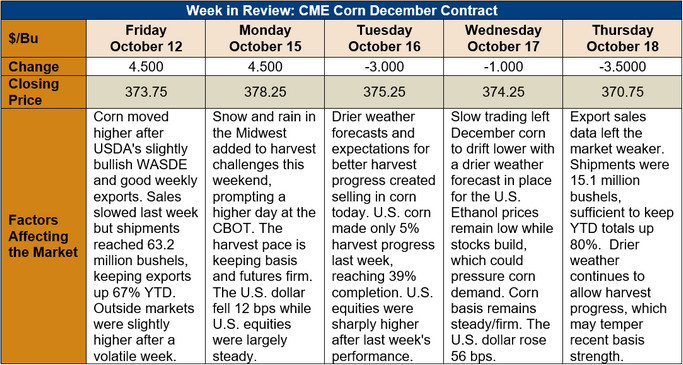

Outlook: December corn futures are continuing their seasonal grind higher after last week’s slightly bullish WASDE and excellent YTD export performance. December futures are up 1.5 cents from last week (+0.4 percent) after selling pressure late this week pulled the market back from recent highs.

This week’s USDA Export Sales report featured 0.3825 MMT of new-crop corn sales and exports of 1.1 MMT. YTD bookings (exports plus unshipped sales) reached 21.088 MMT, up 41 percent from this time last year. U.S. corn remains competitive on the world market and foreign exchange rates will likely be a key determinant of near-term export performance.

The U.S. Midwest has suffered more rain and snow that delayed harvest progress. On Monday, the USDA said farmers advanced the harvest 5 percent from the prior week, a slower-than-normal pace for early-October. The harvest stands at 39 percent complete (versus 35 percent on average) with 96 percent of U.S. corn rated “mature.”

The slower harvest pace has reduced farmer selling and kept basis levels stronger-than-normal. Cash corn prices averaged $3.32/bushel this week, in-line with last week and 31 cents higher than this time last year. With the weather expected to improve in the coming days, accelerating the harvest, cash prices could see more pressure as farmers become more aggressive sellers.

From a technical standpoint, December corn futures are slowly trending higher. Earlier this week, the market closed above the technically-important 100-day moving average but closed below this market today. Funds are estimated to be net short the corn market and were active sellers when futures neared $3.75/bushel. Demand, particularly from ethanol and exports, remains key to determining the market’s direction. If commercials continue to view current prices as a good value, corn futures are likely to continue their seasonal march higher.