Chicago Board of Trade Market News

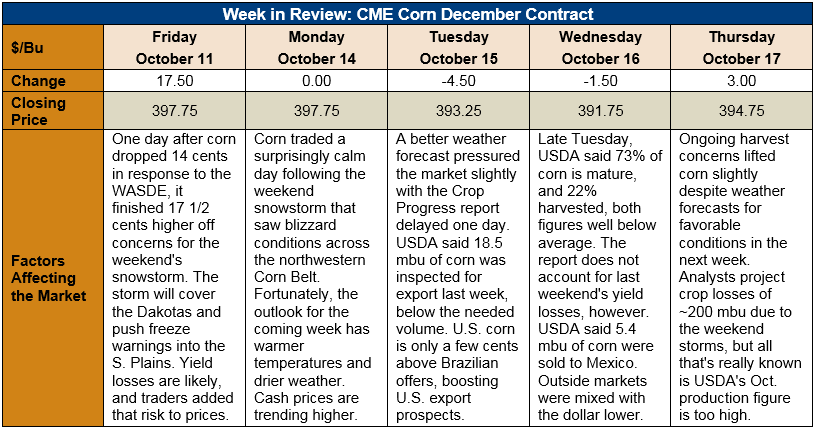

Outlook: December corn futures are 3 cents (0.8 percent) lower this week after the market rejected the bearishness of USDA’s October WASDE and moved higher on winter storm concerns. The market has largely traded sideways this week, trying to estimate possible losses from the storm and assessing the demand outlook.

Following the October WASDE, the biggest news item in the corn markets this week was last weekend’s winter storm that dropped snow and blizzard conditions across Montana, the Dakotas, and parts of Minnesota and Iowa. The storm caused lodging in some fields and is likely to have caused substantial yield losses. Estimates of possible crop losses seem to average near 5 MMT (200 million bushels), but the only thing certain is that USDA’s 2019/20 production figure will likely come down substantially in future reports.

Late Tuesday, USDA said that 73 percent of U.S. corn is mature, down from the five-year average maturity percentage of 92 percent. The report also noted 22 percent of U.S. corn has been harvested, predominantly in the South, which is down from the average pace of 36 percent harvested. The Midwest has seen generally favorable weather conditions this week that should have accelerated final maturation of the crop and allowed combined to enter fields further north.

The weekly Export Sales report is delayed until Friday due to the U.S. federal holiday on Monday. The weekly Export Inspections report, however, showed 470,000 MT of corn inspected for export last week, down slightly from the prior week. YTD export inspections are down 64 percent. The report also included 38,000 MT of sorghum exports, bringing YTD exports for that commodity up 87 percent. U.S. FOB NOLA corn prices have become increasingly competitive against Brazilian offers, leading to expectations of larger exports/sales in the coming weeks.

Cash prices are slightly lower this week with the average price across the U.S. reaching $146.91/MT. Barge CIF NOLA values are 1 percent higher while FOB NOLA prices are firmer at $176.50/MT for October shipment. Basis is slightly weaker this week with early harvest farm sales in the South pressuring some local prices.

From a technical standpoint, December corn rejected the weak reversal pattern formed during last Thursday’s post-WASDE trading and has since confirmed the long-run trend higher. The seasonal lows have almost certainly been made, meaning the seasonal tendency is for corn to slowly move higher. With crop losses likely to be significant in parts of the northern Midwest this year, the outlook remains bullish. Technical selling was notable at the 200-day moving average on Monday, but the market has since found additional support points. Unless an amazingly bearish demand story develops, the outlook for corn is steady/higher.