Chicago Board of Trade Market News

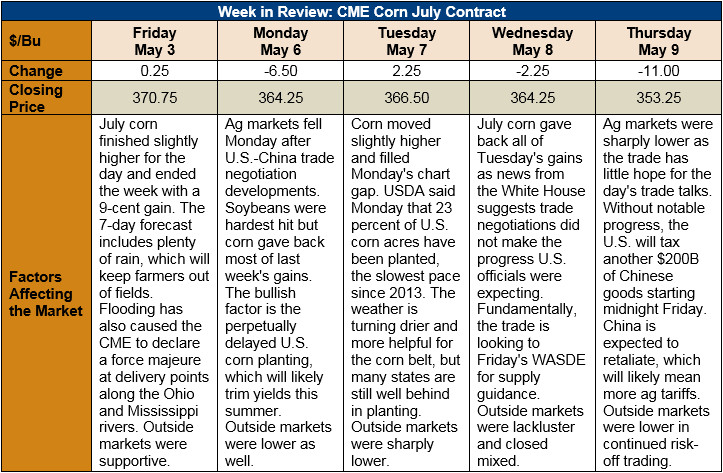

Outlook: July corn futures are 17.5 cents (4.7 percent) lower than last Thursday’s close as geopolitical news has weighed heavily on the market. With trade shocks (hopefully) behind the market, the trade is turning its attention to the May WASDE on Friday. The report is expected to be bearish, but some bullish revisions are possible.

The most-watched number in tomorrow’s WASDE will likely be the 2019 U.S. corn acreage figure. USDA should reduce its estimate from 92.8 million acres in the agency’s March Planting Intentions report. The motivation for the reduction is the weather across the Midwest, which has delayed planting. The degree to which the May WASDE will reflect the impact of flooding and/or the persistent wet weather and delayed planting, however, is still debated. The market seems to be bracing for a modest reduction in the May WASDE, followed by a larger (likely) reduction in June, after crop insurance deadlines have passed.

The slow pace of planting so far was evident in Monday’s USDA Crop Progress report, which showed that 23 percent of U.S. corn acres have been planted. That is half the five-year average pace, with notable states such as Illinois and Iowa lagging their historic norms. The good news is that farmers have proven time and again that, with modern technology, they can plant an amazing number of acres very quickly when given the chance. If Mother Nature gives farmers a chance, plantings can quickly catch up.

USDA’s weekly Export Sales report featured net sales of 294.5 KMT and weekly exports of 1.154 MMT. The export figure was down 16 percent from the prior week, but YTD exports are up 10 percent. YTD bookings, however, are down 10 percent, which is slightly below USDA’s anticipated yearly decrease in exports of 6 percent. Other Export Sales highlights include 11 KMT of sorghum exports and 800 MT of barley exports. Barley exports are up 53 percent YTD.

U.S. cash corn prices are lower this week but have avoided much of the weakness battering futures prices. Cash sales have been slow on declining prices and logistics issues across the U.S. river system that are discouraging grain movement. CIF NOLA barge values are slightly lower this week while FOB U.S. Gulf values are largely steady.

From a technical standpoint, July corn is nearing its contract low posted on 25 April but found support at this point during today’s trading. Commercials have been active buyers near contract lows and were likely responsible for today’s support. The market has posted several interesting developments, the 25 April contract low and this week’s chart gap lower. With the chart gap filled and the market having walked back near the contract low, two technical criteria have been filled, which leaves the market with room to move either way. Traders, already holding a massive short position, are reluctant to extend their position without solid fundamental justification and will be ready with large short-covering volume on bullish news. Thus, If USDA provides anything less than a majorly bearish report, contract-low support will likely hold – and the market could work its way higher.