Chicago Board of Trade Market News

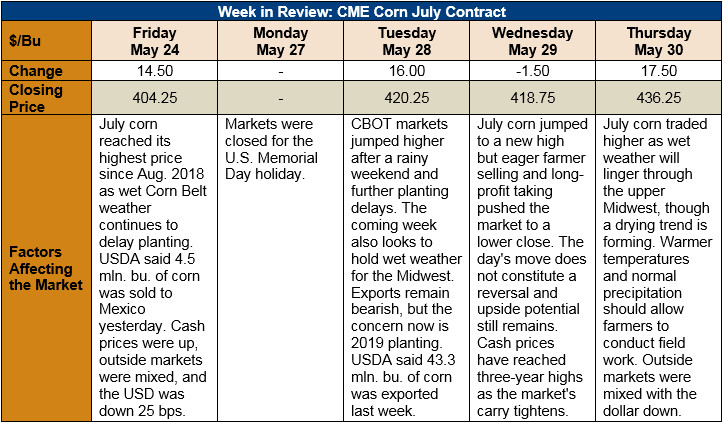

Outlook: July corn futures are 32 cents (7.9 percent) higher than last Thursday’s close as wet weather continues to hamper field work and increase the odds of lower yields in 2019. The weather-induced planting delays will certainly increase the number of prevented-planting acres and the market is now trying to determine just how many acres that will be. The market’s current role is to move prices higher to encourage farmers to plant corn as they are able. The market has greatly improved the economics of growing corn this year and the question now is when the weather will cooperate.

On Monday, USDA said 58 percent of the U.S. corn crop was planted, advancing just 10 percent from the prior week. The crop is behind its normal planting pace, with 90 percent of the crop typically planted by this date. Yield potential tends to decline for corn planted in June and USDA may lower its yield forecast in coming WASDE reports. Seed dealers are reporting significant demand for short-maturing corn varieties, with some even noting that seed supplies for these varieties are tightening quickly.

The USDA’s weekly Export Sales report is delayed until Friday due to the U.S. Memorial Day holiday this past Monday. The agency’s weekly Export Inspections report, however, showed 1.098 MMT of corn shipped last week, up 31 percent from the prior week and keeping YTD shipments up 1 percent. Weekly sorghum exports of 28,000 MT were up 62 percent from the prior week.

Cash corn prices are near three-year highs with the average price reaching $154.09/MT ($3.91/bushel), up 4 percent from the prior week and up 9 percent from last year. Corn prices CIF NOLA barges are $195/MT, up 9 percent, while FOB Gulf offers have increased 6 percent to $193.00/MT. Global corn prices have spiked in recent weeks, leaving U.S. Gulf-origin corn very competitive in the marketplace.

From a technical standpoint, July and December corn futures are extending their rally based on continued slow planting progress in the U.S. Traders are starting to roll out of their July futures positions, however, with Thursday’s open interest falling 40,000 contracts while September and December open interest was steady. July corn, which is more likely to be pulled lower by a potential slowdown in exports due to the rising dollar, could see pressure in the near-term. December corn, however, will continue to trade the weather, planting progress, and the increasing odds that 2019/20 ending stocks will be lower than presently thought. The trend for deferred futures is higher until more is known about 2019 acreage and prevented plantings.