Chicago Board of Trade Market News

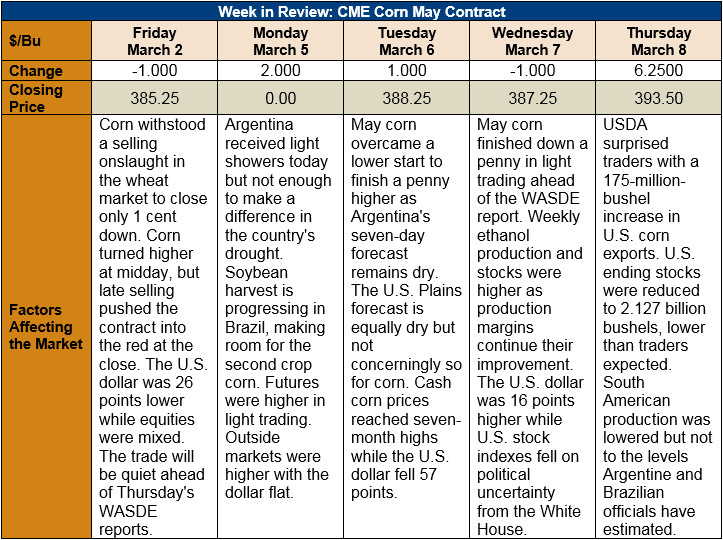

Outlook: The USDA finally gave the world a WASDE report that was bullish corn. The agency increased the U.S. export forecast much more than traders expected and lowered world ending stocks to 199.2 MMT. The latter figure leaves a world ending stocks/use ratio of 16.1 percent, below the February forecast and just slightly above 2013/14 values (the five-year low).

Traders expected supply reductions in South America in today’s report, and USDA did not disappoint. Brazilian corn production fell 0.5 MMT to 95 MMT as the slow soybean harvest pace is threatening second-crop corn plantings in that country. The drought in Argentina is causing trouble for that country’s crop, and USDA lowered 2017/18 Argentine corn production by 3 MMT to 36 MMT.

The big surprise in today’s report was the 8.5 percent increase in U.S. corn exports. The latest figure of 2,225 million bushels is less than 100 million below 2016/17’s record exports.

USDA left the supply side of the U.S. corn balance sheet unchanged today but increased corn for ethanol use by 50 million bushels to 5,575 million. Ethanol margins are rapidly improving across the U.S. with higher DDGS and ethanol values offering producers more incentives to increase production. The net effect of higher exports and ethanol use was to decrease U.S. corn ending stocks 225 million bushels to 2.127 billion, leaving a 14.4 percent ending stocks/use ratio.

The U.S. sorghum balance sheet was largely unchanged in this month’s WASDE, except for a 25-million-bushel increase in feed use and a commensurate reduction in exports. Ending stocks and USDA’s mid-point price forecast were unchanged. USDA increased barley exports by 1 million bushels to 6 million and reduced ending stocks by the same amount.

Looking forward, there is still upward potential in the corn market. It is likely the Argentine crop will drop another 3-5 MMT and CONAB has the Brazilian crop at 87.3 MMT, less than USDA’s 94.5 MMT. With those likely South American supply reductions, U.S. corn exports have room for further increases, as do U.S. prices. Funds are long corn and will not readily relinquish their position until they obtain reliable confirmation of bearish fundamentals. However, until more is known about U.S. planting intentions (and the market seems to be incentivizing more corn acres), the market will likely remain between $3.95 and $4.10 in the December contract.