Chicago Board of Trade Market News

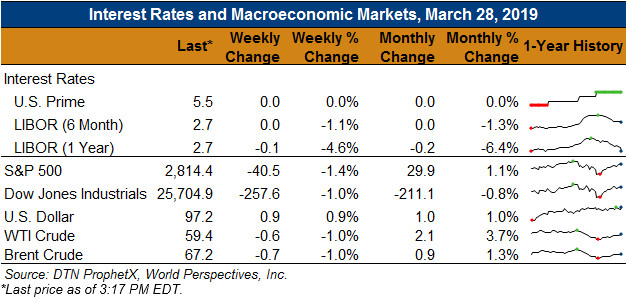

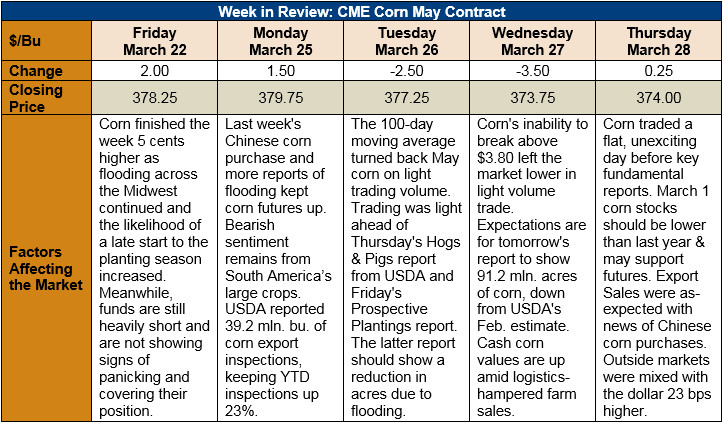

Outlook: May corn futures are down 4.25 cents/bushel (1.1 percent) from last Thursday as the market has been largely directionless ahead of the March 29 Prospective Plantings report. Bullish factors that could shape the market going forward include the Midwest flooding, a lower-than-expected acreage number, and export demand. The bearish side is defined by the large South American crops and the large short position held by managed money traders.

USDA’s weekly Export Sales report showed 904.5 KMT of net sales and 959.5 KMT of exports. The export figure was 26 percent higher than that of the prior week. YTD exports are up 25 percent while YTD bookings (unshipped sales plus exports) are down 8 percent. This week’s report also featured 200 MT of sorghum exports and 600 MT of barley exports. The latter figure was sufficient to keep YTD barley exports up 24 percent.

The Brazilian and Argentine corn crops are developing under good weather, except for anticipated rains across northeast Argentina. The Argentine harvest is progressing well with above-average yields as the harvest approaches the core corn area. The Brazilian second-crop corn is in good condition, but worries are increasing about dryness across southern Brazil.

The U.S. Midwest is still grappling with the fallout from the massive flooding that hit the area in recent weeks, which continues to make river travel difficult and caused rates for barges CIF NOLA and FOB NOLA corn to increase. Cash prices across the U.S. are down slightly this week at $136.38/MT ($3.46/bushel), prices that are down 1 percent from last week and down 1 percent from last year.

The outlook for May corn futures is decidedly mixed. Traders will be watching the March plantings report closely but are more likely to react to a bullish figure from USDA than a bearish one. Should USDA issue an acreage forecast showing higher-than-currently-expected corn plantings, the market is likely to believe that the current cold, wet conditions across the Midwest will result in further acreage cuts later. Conversely, if USDA issues a bullish forecast (lower acreage) the market is likely to move sharply higher with funds covering their short position. The report is likely to create volatility one way or the other.