Chicago Board of Trade Market News

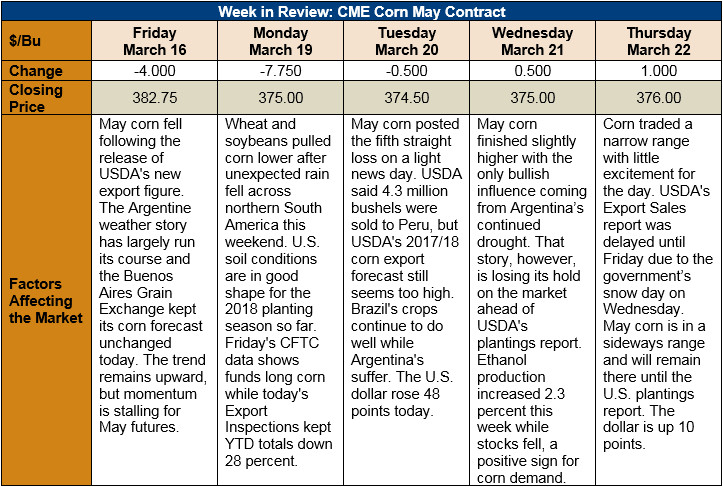

Outlook: The corn market fell sharply last Friday and Monday, but since then has done comparatively little. The futures market’s drop lower was partly due to pronounced weakness in the wheat and soybean futures market, partly from U.S. farmer hedge pressure, and partly from slow export demand. For now, however, the market is waiting for the March Prospective Plantings report for clarity on the U.S. supply situation.

Merchandisers and brokers are reporting farmer selling during the late days of the corn market rally. Basis levels dropped late last week as cash selling accelerated and farmers put on hedges for the coming growing season. Weaker basis/cash prices and hedge pressure combined to help move the futures market lower Friday and Monday.

U.S. export fundamentals remain bearish the corn market. Monday’s Export Inspections report featured volumes that kept YTD totals down 28 percent from last year, even as USDA’s March WASDE report featured upward revisions in the export forecast. Last week’s Export Sales report featured large net sales and exports, which are expected to occur again in this week’s report. Note this week’s report was delayed one day due to inclement weather in Washington D.C. on Wednesday.

The market is largely waiting for USDA’s Prospective Plantings report on March 29. The report will be a key driver for the U.S. supply situation and will likely give the market much needed direction. Private estimates vary widely, from 88.5 million acres planted to corn to 92 million on the high end. The report will also offer a glimpse into whether the current wet weather across the U.S. Delta states is influencing planting decisions from a late-planting-risk perspective.

Until the plantings report, the futures market seems relegated to sideways trade. The Argentine weather story isn’t enough of a factor to lift prices higher amid slow U.S. exports, but there aren’t enough bearish factors to encourage a sell off. Consequently, sideways trading is expected for the coming week before the plantings report.