Chicago Board of Trade Market News

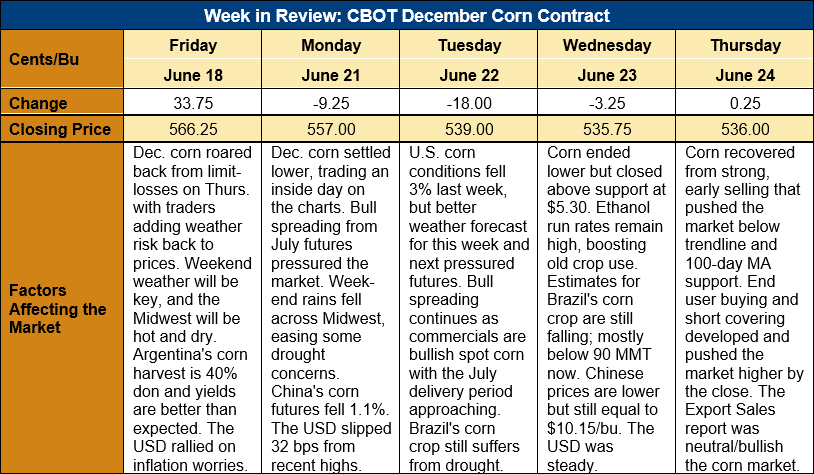

Outlook: December corn futures are 30 ¼ cents (5.3 percent) lower this week as increasingly favorable Midwest weather forecast pressure new crop markets. The 2021 growing season started out with a concerning hot, dry trend but key Midwest corn-producing states, including Iowa, Illinois, and Indiana, received meaningful rains last weekend and this week. That, combined with weather forecasts calling for continued precipitation this week, prompted managed money funds to accelerate liquidation of their long corn positions.

The hot, dry start to the 2021 summer crop growing season pressured crop conditions ratings again last week. USDA reported 65 percent of the U.S. corn crop was rated good or excellent (G/E), down 3 percent from the prior week. The sorghum crop’s G/E rating fell 1 percent to 73 percent while barley ratings slipped 6 percent to 39 percent G/E. Cooler temperatures and rains for the Corn Belt this week are expected to boost corn and sorghum ratings in USDA’s next report. Persistent dryness in the PNW and northern Plains, however, will likely dictate further declines in barely and spring wheat ratings.

While much of the market’s focus this week was on the weather, the trade was also preparing for the 30 June USDA Grain Stocks and Acreage reports. Generally, analysts expect USDA to increase its acreage estimate for both corn and soybeans in the coming report but estimates for the acreage increases are wide-ranging. For corn, most analysts are predicting a 0.89-million-hectare (2-million acre) increase (which would put 2021 planted area at 37.676 million hectares, or 93.1 million acres), but some expectations call for 2.02 million hectares (5 million acres) of additional corn area. Expectations for soybean plantings are more modest, with most analysts predicting a 0.405-million-hectare (1-million-acre) increase.

One key metric from the coming planted acreage report will be which states expanded corn and soybean acreage. In the March Prospective Plantings report, USDA forecast large acreage gains for North and South Dakota, two states that are now suffering from drought. If corn and soybean area is confirmed to have expanded in areas struggling with drought, it will have a negative impact on 2021 production potential. Conversely, area expansion in the Corn Belt, where drought is less prevalent, will provide better assurance of a large 2021 corn crop.

From a technical standpoint, December corn futures broke two supportive trendlines and on Thursday traded below the 100-day MA for the first time since August 2020. End-user buying and short covering was notable on the break below the 100-day MA, and that buying interest helped pull the market to a higher close for the day. December corn continues to work lower into major trading range support at $5.00 ¼ (the 26 May daily low) and long-term trendline support lies at $4.90 ½. So far, bull spreading from July futures and fund selling have pressured new crop corn contracts, but the break to major technical and psychological support may uncover pent-up demand.