Chicago Board of Trade Market News

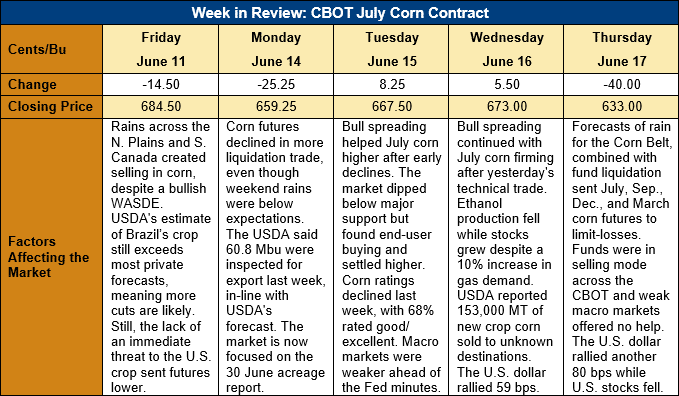

Outlook: July corn futures are 51 ½ cents (7.5 percent) lower this week as a wave of fund selling and long liquidation has pressured the CBOT. Improving weather forecasts for the U.S. are sparking some “risk off” trade and volatility in macroeconomic markets (gold, U.S. stocks, and the U.S. dollar) further contributed to the corn market’s decline. Thursday’s trade also saw a healthy dose of technical trade and sell-stops were triggered below key support levels.

Updated weather forecasts were the biggest trigger for corn futures’ decline. Models have been trending to favor more rain for the Corn Belt and Northern Plains late this week and next along with cooler temperatures for the eastern U.S. next week. That shift towards more favorable growing conditions sparked long position liquidation, even though much of the Corn Belt and western United States remain in a drought. The long-run forecasts call for hot, dry weather in July but confidence in those models remains low. For now, the trade seems to be favoring near-term weather forecasts, which are presently leaning bearishly on the markets.

Another factor pressuring the CBOT on Thursday was the 80-point rise in the U.S. Dollar Index. After nearing its two-year lows in mid-May, the U.S. Dollar Index has rallied over 200 basis point (bps), with 138 of those points coming in the past two days. That has set grain markets, especially wheat which is particularly sensitive to changes in the dollar, on edge. Additionally, U.S. stocks are weaker on rising inflation concerns while gold futures are sharply lower in liquidation trade. The latter two factors don’t directly impact corn futures, but heightened volatility often prompts funds and risk managers to trim exposure in ag markets too.

The Export Sales report showed 212,800 MT of net 2020/21 corn sales with 1.661 MMT of exports last week. The export volume was up 1 percent from the prior week and put YTD exports up 75 percent at 54.573 MMT while YTD bookings are up 68 percent at 69.315 MMT. New crop (2021/22) net sales totaled 276,000 MT, putting total new crop bookings at 15.37 MMT., up 347 percent from this time last year.

U.S. basis levels remain firm but are retreating from May’s record highs. The average basis bid across the U.S. this week was 7 cents over July futures (7N), down from 9N last week but above the -57N observed this time last year. Yellow corn FOB Gulf prices are down 8 percent this week at $284.63/MT for July shipment.

From a technical standpoint, July corn futures broke two major support levels this week (the 28 May daily low at $6.51 ¼ and trendline support at $6.35), which points to still lower trade. The next major technical target is the 26 May daily low at $6.02 ¾ with the 100-day moving average ($5.93 ¼) below that. Given ever-shrinking estimates for the Brazilian safrinha crop and growing estimates for China’s 2021/22 corn imports, it seems unlikely the market will selloff below these two major technical levels. Cash market sources also say end-users are adopting hand-to-mouth procurement strategies, and a market dip to $6.00 may prove a highly attractive buying opportunity.