Chicago Board of Trade Market News

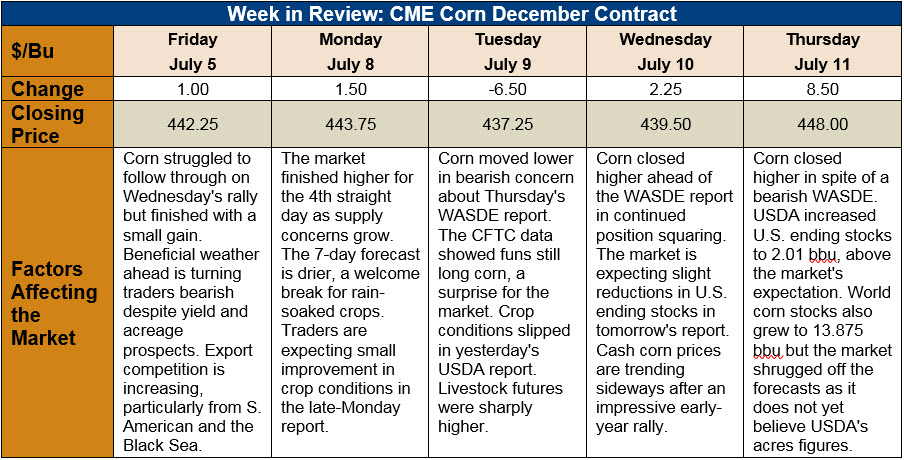

Outlook: December corn futures are 5 ¾ cents (1.3 percent) higher this week as the market’s Thursday rally apparently ignored what was initially perceived as a bearish WASDE. Traders initially read the report in a bearish light with lower 2018/19 U.S. exports and growing 2019/20 ending stocks and sold the market lower. Late in the trading day, however, strength entered the market again on apparent questions about the USDA’s acreage figure. While the WASDE data is bearish, the uncertainty about 2019 U.S. acreage is allowing traders to keep price premiums in place until more is known.

USDA left 2019 U.S. acreage and yield unchanged from its most recent forecasts but noted the acreage figure would be subject to revision based on another survey. The data from this survey will be released in August if the results are sufficiently different from the June acreage reports. USDA increased feed and residual use for corn by 635 KMT (25 million bushels) while food, seed and industrial (FSI) use was cut slightly. Ending stocks were increased 8.509 MMT (335 million bushels) to 50.803 MMT (2.0 billion bushels). USDA lowered its season-average corn forecast $3.94/MT (10 cents/bushel) to $145.66/MT ($3.70/bushel) on the higher stocks estimate.

Elsewhere in the WASDE, USDA slightly lowered its 2019/20 production estimate for sorghum and lowered its ending stocks forecast 25 KMT (1 million bushels). USDA increased 2019/20 U.S. barley acreage 200,000 acres and reduced its yield forecast 1.5 bushels/acre. The agency’s production forecast grew to 3.723 MMT (171 million bushels) and the feed and residual forecast doubled to 435 KMT (20 million bushels). Ending stocks increased slightly and USDA lowered its season-average farm price 10 cents/bushel.

Globally, USDA increased 2019/20 world ending stocks to 298.92 MMT on higher production figures. Ukraine’s corn production estimate was increased based on increased acreage data. The agency also increased Argentina’s 2018/19 corn production figures based on current yield data as well as increasing export forecasts for that country and Brazil.

The latest Export Sales report featured 505.4 KMT of net sales and 1.136 MMT of weekly exports. The export figure was 287 percent higher than the prior week. YTD exports total 44.025 MMT (down 5 percent) while YTD booking amount to 49.421 MMT (down 15 percent). The report also noted 86 KMT of sorghum exports and 2.2 KMT of barley shipments. Barley bookings (unshipped sales plus exports) are up 6 percent YTD.

Monday’s Crop Progress and Conditions reports showed 57 percent of U.S. corn rated good or excellent, behind the typical figure of 72 percent. The report also found 8 percent of U.S. corn in the silking stage, behind the five-year average pace of 22 percent. Warm/dry weather for most of the Midwest this week should help crop development, though rains will be needed next week if the heat continues.

U.S. cash corn prices are steady this week with most grain cash markets having entered a sideways trend. Basis in the Eastern Corn Belt remains abnormally firm in testament to the extremely late planting and poor crop conditions there. CIF NOLA barge values are steady this week at $190.50/MT while FOB NOLA prices are down fractionally at $199.50/MT for nearby shipment.

The latest CFTC data shows funds still holding a long position in corn and defending it aggressively. From a technical standpoint, December corn could be forming a head-and-shoulders top but today’s higher close casts doubt on that development. More likely, the market is apt to trade sideways in a $4.20-4.50/bushel range until the final acreage figures are released. With the possibility for reduced area and the crop in below-average condition, traders are not willing to call a bear market just yet.