Chicago Board of Trade Market News

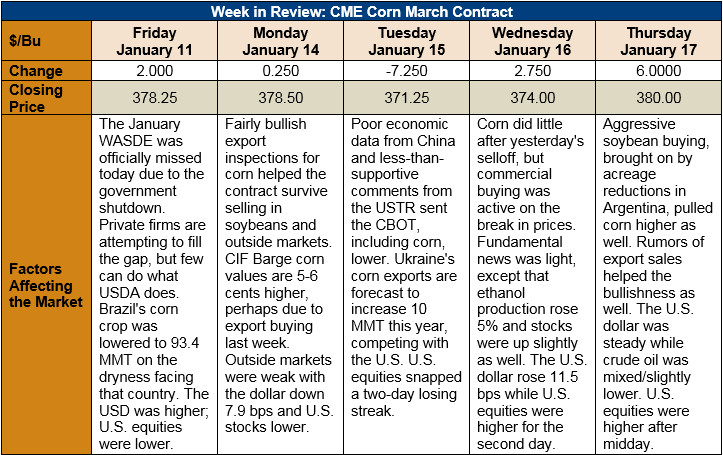

Outlook: March corn futures are 1 ¾ cents (0.5 percent) higher this week as Thursday’s rally offset Tuesday’s losses. The U.S. government is still shutdown, meaning the market officially missed the January WASDE report along with other key reports, and will likely miss future reports as well. With the government shutdown and the market in the typical winter fundamental news drought, traders have little to get excited about. Consequently, corn is largely heading sideways.

Fortunately, USDA AMS is still publishing the Export Inspections report despite the government shutdown. That report, the only insight into U.S. grain exports, showed 1.013 MMT inspected last week, bringing marketing-year-to-date totals to 19.468 MMT (up 61 percent from this time last year). This week’s report also showed 6,600 MT of sorghum shipped abroad last week.

U.S. cash corn prices are trending sideways, averaging $134.62/MT (-1 percent from last week; +7 percent from the prior year). Farmer selling increased last week with futures above $3.80/bushel, but that dried up on Tuesday’s break in the CBOT. Last week, Barge CIF rates rose 5-6 cents, perhaps indicative another round of export business being executed. Monday’s Export Inspections report should be able to confirm this idea.

March corn is trending sideways with Tuesday’s bearish break below the trendline being erased by Thursday’s sharp move back above it. The contract faces resistance at $3.80/bushel, which could elicit more hedge selling or short-position taking. Presently, there are growing bullish factors for corn, including likely increases in U.S. exports given the competitiveness of U.S. product on world markets, and dryness in Brazil. Currently these factors are insufficient to spark a major rally but should be watched. The world is not oversupplied with corn, which could make production setbacks around the world more important to the U.S. futures market.