CHICAGO BOARD OF TRADE MARKET NEWS

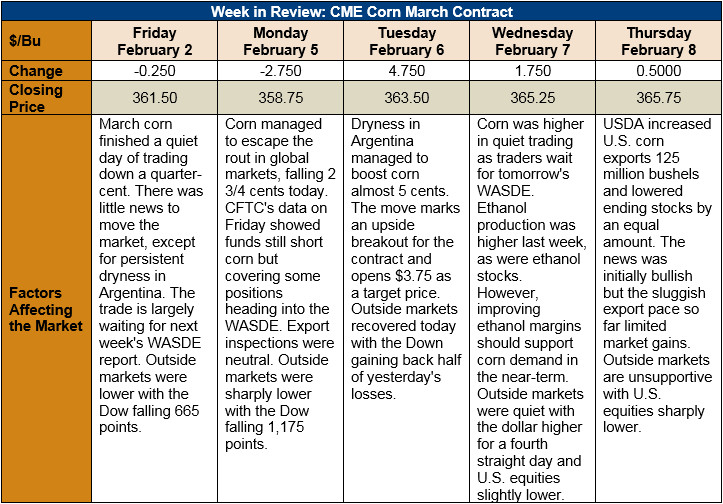

Outlook: USDA surprised the markets today with significant revisions to its 2017/18 corn U.S. corn balance sheet. Most notably, the agency reduced its ending stocks forecast by 125 million bushels to 2.352 billion. Corn exports were increased by 125 million bushels, which drove the ending stocks reduction, as the agency sees U.S. corn’s competitiveness (currently the cheapest FOB prices in the world) as encouraging U.S. exports. USDA increased the season-average corn price 5 cents to $3.30/bushel. The futures market initially interpreted the report as bullish, but the slugging corn export pace observed so far this year limited market gains.

The world corn outlook featured slightly bullish changes to the global balance sheet as well. World corn production in 2017/18 was lowered 2.8 MMT on drought and persistent heat in Argentina and reductions in Ukraine’s official production estimates. World corn production is currently pegged at 1041.7 MMT with world ending stocks at 203.1 MMT.

The USDA left its January forecasts for sorghum, barley, and oats supply and demand factors unchanged in this month’s report. Similarly, USDA did not change its estimate of feed wheat volumes, keeping the 2017/18 estimate of wheat for feed and residual use at 100 million bushels.

From a technical perspective, March corn is trending higher with three consecutive days of higher highs and higher closes. The 10- and 100-day moving averages offer technical support points and are confirming the momentum higher. The 200-day moving average ($3.75) stands as the next upside target, as well as a key resistance point. While there is growing bullish sentiment, it will take confirmation of global production shortfalls or a takeoff in U.S. exports before March corn will challenge the 200-day moving average.