Chicago Board of Trade Market News

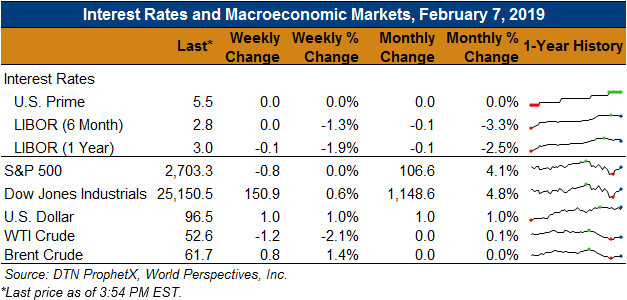

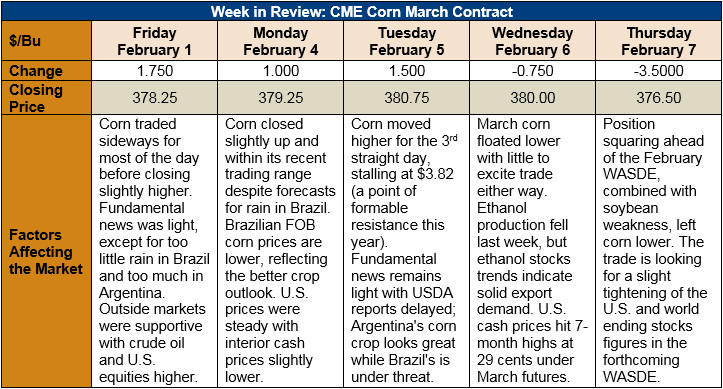

Outlook: March corn futures have dutifully stepped sideways (down 1 ¾ cents or 0.5 percent from last week) this week as fundamental news remains light ahead of USDA’s WASDE to be released Friday, February 8. The major themes expected in the coming report are a general tightening of U.S. and world ending stocks. The trade will also be watching for updated Brazilian and Argentine production estimates, given the extreme weather both countries have encountered this year.

For tomorrow’s WASDE report, the trade is looking for slight downward revisions to the U.S. yield and harvested acres figures, which could lower production slightly. On the demand side, traders expect either no changes or a slight upward revision to the U.S. corn export forecast. Exports started the year at a pace sufficient to justify major upward adjustments but have since tapered off. USDA could also lower its estimates for feed and ethanol corn use in the coming report. U.S. ending stocks could be reduced by 67 million bushels, from 1.781 billion in December to 1.714 billion (the average trade estimate).

Internationally, the WASDE is expected to show 93.3 MMT of Brazilian corn production and 43.1 MMT of Argentine corn, the former likely being reduced by the country’s drought and the latter buoyed by excellent rains. World ending stocks are expected to be near 307.5 MMT, down from the USDA’s December estimate of 308.8 MMT.

U.S. corn export figures are still delayed due to the effects of the recent partial government shutdown. Data released for the end of December, however, show weekly exports of 1.006 MMT, which brings YTD shipments up 75 percent from the same time last year. The report also featured 11,100 MT of sorghum exports and 500 MT of barley shipments.

From a technical standpoint, December corn is range-bound between $3.75 and $3.82 and little has been able to shake it from this range in recent weeks. Tomorrow’s WASDE will be a much-needed fundamental update that could have significant impacts on the market. Managed money funds are thought to be slightly long the corn market, so a bearish WASDE may have more downside risk due to position liquidation. Presently, futures spreads and cash prices (up 1 percent from last week and up 6 percent from this time last year) do not indicate that commercial firms feel supplies tightening. Overall, the market seems to be expecting a more or less neutral WASDE.