Chicago Board of Trade Market News

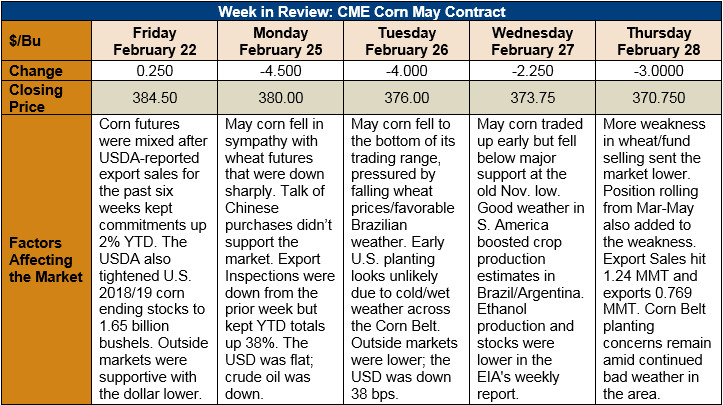

Outlook: May corn futures are 14 ¼ cents/bushel (3.7 percent) lower this week as fund selling and prolonged weakness in wheat futures have eroded support. The contract fell below major technical support at the November 27, 2018 daily low, which brought additional position liquidation. The futures market seems to be following technical indicators more closely right now, despite what appears to be a tightening corn balance sheet. Fundamentally, corn exports and other demand-side factors remain supportive, as does USDA’s most recent ending stocks estimates.

The USDA’s annual Ag Outlook Forum provided the agency’s first look at the 2019/20 crop forecast. Notably, the agency forecast 92 million acres planted to corn this year, up 2.9 million from last year. Assuming a trendline yield, the agency’s production estimate hit 378.226 MMT (14.890 million bushels). USDA increased U.S. domestic corn use slightly and pegged 2019/20 exports at 62.868 MMT (2.475 billion bushels). The agency lowered ending stocks to 41.912 MMT (1.650 billion bushels) and dropped the ending stocks/use ratio to 11 percent. USDA increased its expectations for the average farm price to $143.69/MT ($3.65/bushel).

This is, of course, the first estimate of the 2019/20 crop year and substantial, subsequent forecast revisions are likely. Notably, some private analysts have 2019 corn acreage near 93 million acres, based on the current ratio of harvest-contract soybean and corn futures. The U.S. yield will be updated throughout the growing season as well, based on growing season weather (which, for now, USDA assumes will be normal) and actual yields. Additionally, demand-side estimates will be updated as more clarity is gained on the South American crop and international demand.

The USDA’s latest Export Sales report featured 1.24 MMT of net sales and 0.769 MMT of exports. The sales figure was sufficient to keep YTD bookings (exports plus unshipped sales) up 1 percent versus this time last year. Exports have been supportive for the corn market with aggressive shipments early in the marketing year.

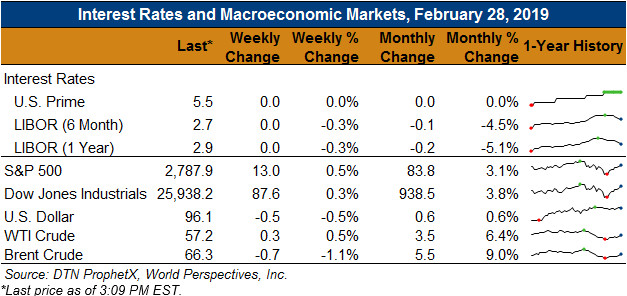

U.S.-average cash prices are lower this week following the futures market selloff. Prices are averaging $133.44/MT ($3.39/bushel) this week, down 3 percent from last week and 3 percent from last year. Basis levels, however, remain firm with rail and CIF rates rising due to poor weather and logistics issues across the Midwest.

From a technical standpoint, May futures are in a short-term downtrend that faces major support at the life-of-contract low ($3.63 ¼). Funds have been active sellers on this move but are likely to cover some short positions as prices reach this point. Wheat prices could shape part of the corn price outlook as well, with any rally in that market (based on, for example, lower-than-expected winter wheat acreage) likely to support corn as well. Additionally, commercial buying has reportedly been substantial as prices have moved lower and that is likely to be supportive in the near-term. Overall, the market seems to have experienced significant short-term selling that does not seem likely to continue based on corn or wheat market fundamentals. Consequently, the outlook is for May corn to break higher in the near-term on a break in fund selling or strong commercial buying.