Chicago Board of Trade Market News

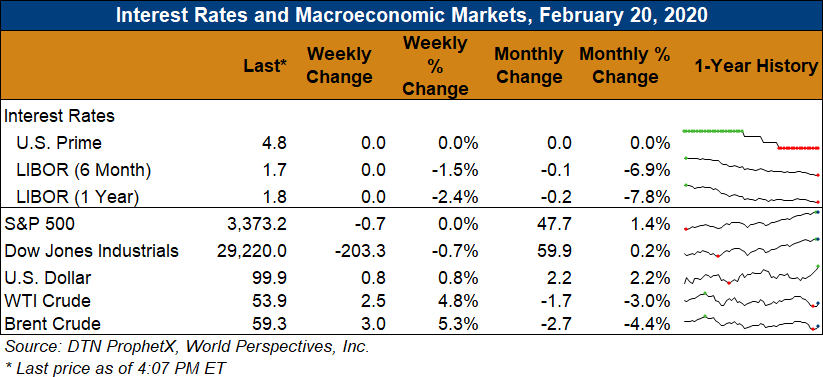

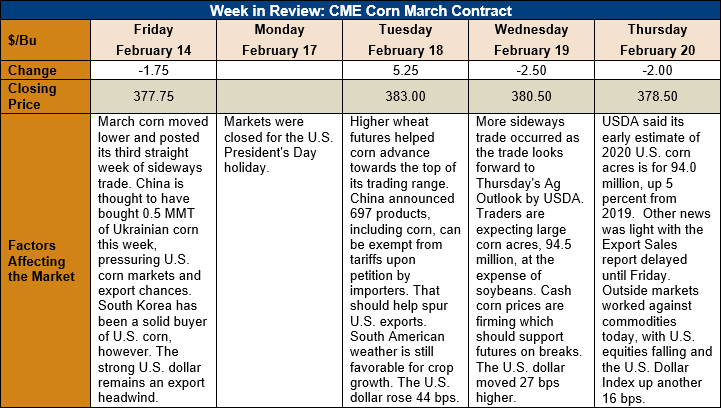

Outlook: March corn futures are ¾ cents (0.2 percent) lower this week as the market continues its sideways pattern. Fresh fundamental news is typically light during this time of year, and 2020 has been no exception so far.

At the opening session of the USDA’s annual Ag Outlook Forum in Washington, D.C. this morning, the agency projected 2020 corn acreage of 94 million acres, which, if realized, would be 5 percent higher than the 89.7 million planted in 2019. The agency also set early expectations for the 2020/21 U.S. average corn price at $3.60/bushel. The agency hinted at stronger ag exports due to the Phase One U.S-China trade deal but offered few specific forecasts. USDA did provide a forecast that shows expectations for a modest decline in global corn stocks over the coming 5 years. The trade interpreted the morning’s news as slightly bearish for 2020 futures prices.

The weekly Export Sales report is delayed one day due to Monday’s holiday in the U.S. and will be released Friday, February 21. The Export Inspections report, released earlier this week, showed 795,000 MT of corn was inspected for export last week, up 1 percent from the prior week. YTD inspections are down 49 percent. The report also showed 74,000 MT of sorghum inspections and 144 MT of barley exports. YTD sorghum and barley exports are up 63 and 315 percent, respectively.

Cash corn prices continue to firm across the U.S. with solid commercial demand underpinning values. Basis levels now average 10 cents under March futures, up from last week and well above last year’s level of 62 cents under March futures. Improvements in river transportation logistics this week have allowed barge CIF NOLA prices to work their way slightly lower while FOB Gulf offers are unchanged this week at $177/MT for spot shipment.

From a technical standpoint, March corn remains range-bound and continues to find eager sellers on rallies and willing buyers on breaks. Noncommercial traders still hold a small net long position, which is helping keep the market supported. Tuesday’s wheat market rally created spillover buying in corn futures and continued strength in that market may also help corn grind higher. Futures spreads are firming slightly but remain well within normal values for this time of year, suggesting commercial firms are seeing neither bearish nor bullish conditions presently. With the Outlook Forum’s numbers now factored into the market, traders and analysts will return to watching spring weather in the U.S. to gauge just how close the final planting number will be to today’s forecast.