Chicago Board of Trade Market News

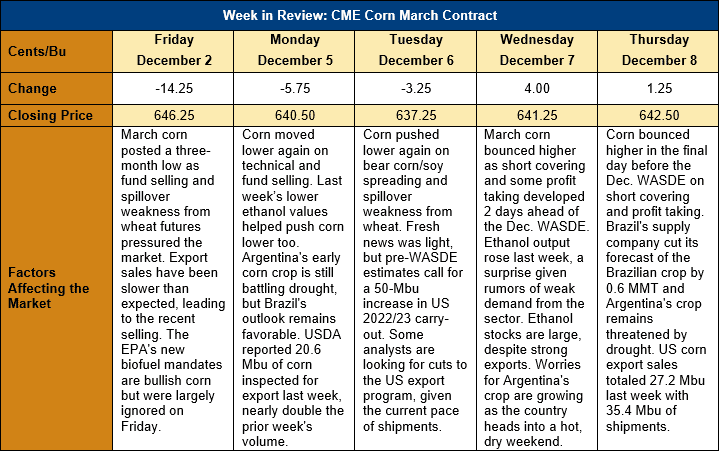

Outlook: March corn futures are down just 3 ¾ cents (0.6 percent) from last Friday’s close as the market stabilized after early-week fund selling. Corn futures pushed lower initially on a combination of technical liquidation and spillover selling from a weak wheat market, but bounced higher heading into the December WASDE. Broadly, analysts are looking for modest increases in U.S. 2022/23 ending stocks in Friday’s report, but there was a growing sense this week that the selloff was overdone. That prompted short-covering and some fresh long interest, especially with Midwest basis levels remaining firm. Basis bids are averaging 14 cents over March futures (14H) this week, steady with last week but well above the -10H recorded this time last year.

The December WASDE does not usually feature large changes to the U.S. balance sheet, but pre-report surveys indicate this year’s report may deviate from that pattern. The average of pre-report estimates suggests USDA will increase the U.S. 2022/23 carry-out estimate by 1.49 MMT to 31.52 MMT. One of the big questions the market is looking for will be USDA’s assessment of the Argentine corn crop, which is suffering from a drought. The agency is likely to pare down its forecast of that country’s production potential, which would pare down the world ending stocks estimate. Pre-report guesses indicate most analysts are looking for a 3-10-MMT reduction in world 2022/23 ending stocks, and the average forecast calls for carry-out of 300.9 MMT. That would be down 7 MMT from the November WASDE.

The Export Sales report featured 691.6 KMT of net corn sales last week and 900.1 KMT of exports. The export figure was up 161 percent from the prior week and YTD exports total 6.673 MMT, down 37 percent.

Technically, March corn futures are stabilizing after their recent weakness and seem to have found support at $6.35. Seasonally, corn futures tend to strengthen heading into the New Year with the prospect of larger exports in the spring. The December WASDE will certainly have a lot to say about the corn market’s direction heading into 2023 but futures look fairly valued relative to pre-report expectations. While recent futures price action has seen some selling pressure, cash prices and basis remain strong overall, especially along the river system and in the eastern Corn Belt.