Chicago Board of Trade Market News

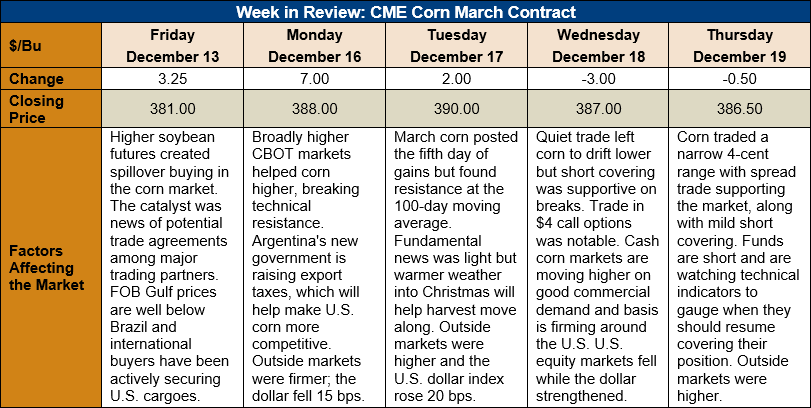

Outlook: March corn futures are 5.5 cents (1.4 percent) higher this week following a 7-cent rally on Monday and sideways trade since then. Geopolitical developments have been broadly favorable for the CBOT markets and speculative traders’ short covering action has further supported futures values. The U.S. dollar index has moved well below its recent highs posted in late November, which has helped increase the competitiveness of U.S. corn on the export market. International demand for U.S. corn is picking up, as evidenced by recent USDA reports.

U.S. corn export sales and shipments both reached marketing year highs last week. The weekly Export Sales report featured 1.71 MMT of 2019/20 corn net sales and exports of 720,000 MT. Export volumes were 36 percent higher than the prior week. YTD exports stand at 7.6 MMT, down 55 percent from the prior year. YTD bookings (unshipped sales plus exports) are down 42 percent at 17.2 MMT. Other Export Sales highlights include 88,000 MT of sorghum exports, putting YTD sorghum bookings up 139 percent. Barley shipments reached 600 MT last week, putting YTD bookings 3 percent above last year’s value.

Cash corn prices are higher this week, following the futures rally, with the average price across the U.S. reaching $145.54/MT. Basis levels have narrowed under increasing commercial procurement interest, reaching 17 cents under March futures this week. Barge CIF NOLA offers are 4 percent higher at $168.50/MT while FOB NOLA asking prices are $174.25/MT for spot shipment.

From a technical standpoint, March corn has entered a new trading range after a rally early this week. The 100-day moving average has been key resistance that bulls have been unable to break so far. On the other side, the 40-day moving average has become key short-term support, and the market has largely bounced between these points this week. Recent buy corn/sell wheat spread trade has been supportive, as has some continued short covering on market dips. Notably, funds are still net short the corn market by a substantial volume but have covered some of that position this week. Now, they are watching technical resistance (namely, the 100-day moving average) before covering anything further. Another notable development is the growing interest in March $4 call options. Overall, the corn market looks to maintain its current range, supported by technical factors and firmer cash prices, and possibly grind higher into the New Year.