Chicago Board of Trade Market News

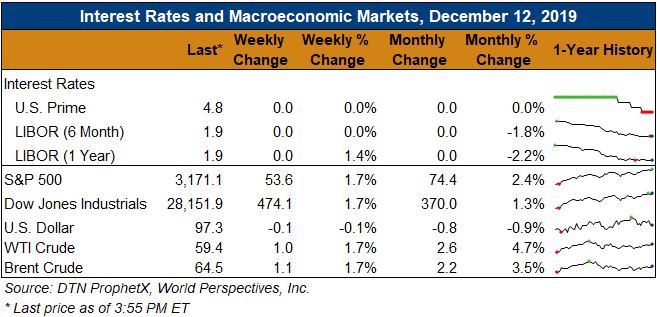

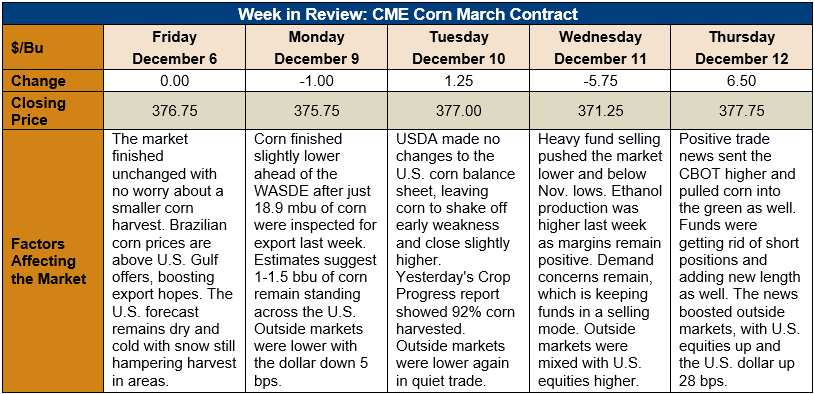

Outlook: March corn futures are 1 cent (0.3 percent) higher this week following quiet trading early in the week and two days of larger price swings on Wednesday and Thursday. The December WASDE offered no changes to the U.S. 2019/20 corn balance sheet, and modest adjustments to international crop outlooks.

The December WASDE saw USDA make no changes to the 2019/20 U.S. corn balance sheet, despite this year’s extremely delayed harvest. On Monday, USDA said 8 percent of the corn crop is yet unharvested, most of which is located in the Dakotas. USDA is likely to make final 2019/20 crop yield/production revisions in the January WASDE, as well as incorporate data from the December 1 Grain Stocks report.

Internationally, USDA boosted world 2019/20 corn production, based partly on a bigger crop in China. Chinese corn production was increased to 260 MMT, up from 254 MMT estimated in November. USDA lowered its expectations of corn production in Australia (due to drought) and Canada (due to poor yields). The agency left its estimates of the coming South American crops unchanged but will likely update them in January. USDA lowered its export forecast for Canada, Mexico, and Laos and raised world ending stocks 4.6 MMT to 300.561 MMT. Notably, however, if Chinese corn stocks are excluded, world ending stocks fell 1.17 MMT to 99.49 MMT.

The weekly Export Sales report featured 1.3 MMT of 2019/20 corn gross sales and 873,000 MT of net sales. Exports last week reached 531,000 MT, up 7 percent from the prior week. YTD exports stand at 6.875 MMT, down 56 percent from the prior year. YTD bookings are down 44 percent at 15.56 MMT. Other Export Sales highlights include 34,000 MT of sorghum gross sales and 16,200 MT of exports, putting YTD sorghum bookings up 120 percent. Barley shipments reached 900 MT last week, putting YTD bookings 3 percent above last year’s value.

Cash corn prices are lower this week with the average price across the U.S. reaching $138.75/MT. Futures prices are largely unchanged from last week’s report, but basis widened to 25 cents under March futures. Barge CIF NOLA values are down 4 percent this week while FOB NOLA offers are largely unchanged at $165.75/MT.

From a technical standpoint, March corn flashed a strongly bearish signal on Wednesday by closing below its November lows. On Thursday, however, that looked to be a false signal as the market rallied 6 ½ cents and briefly traded above the 20-day MA. The market closed above a downward-sloping trendline that had been a key resistance point for the market, and the close above that point could bring in additional market support. Thursday’s above-average trading volume is also a signal that the market’s recent slide may be over. Funds still hold a large short position in corn futures, but with trade news turning positive, they may look to liquidate that position in the near-term.