Chicago Board of Trade Market News

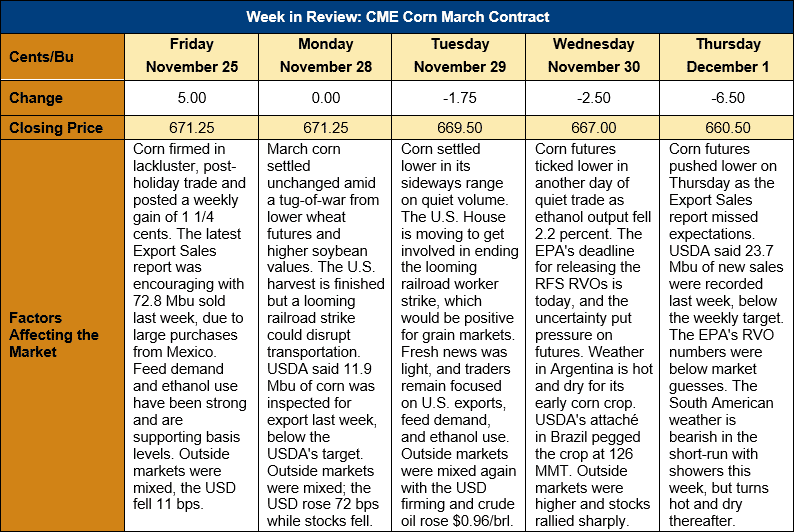

Outlook: March corn futures are down 10 ¾ cents (1.6 percent) this week as the market continues to chip sideways following the completion of the U.S. harvest. The harvest ended with minimal seasonal pressure on basis or flat prices, highlighting the strength of underlying feed and ethanol demand. Presently, Midwest basis levels are averaging 16 cents over March futures (+16H), up from last week’s 14-over quotes and the -10H reported this time last year.

The Export Sales report featured 602.7 KMT of net corn sales last week and 344 KMT of exports. Exports were down from the prior week and YTD exports total 5.77 MMT, down 40 percent. Exports are off to a slow start so far this year but tend to seasonally increase in the spring.

Ethanol demand remains a bright spot for the corn balance sheet with the EIA reporting a seventh consecutive week of production above 1 million barrels per day. On Thursday, the USDA said 11.403 MMT (448.9 Mbu) of corn was used for fuel ethanol in October, a figure up 17 percent from September but down 4 percent from 2021. The October production figure represented a strong rebound from the five-year low set in September. Collectively, corn used for fuel, industrial, and beverage ethanol in October totaled 11.695 MMT (460.4 Mbu), up 17 percent from the prior month.

Technically, March corn futures remain lodged in a sideways trading pattern with support at $6.53 (the 15 November low) and trendline resistance at $6.90 ¼. Funds remain heavily long the market amid concerning weather patterns in South America and the strong domestic demand. March futures settled below the 100-day moving average on Thursday, which will likely be of some importance to technical traders. Commercial buying has remained strong on breaks in the market, however, and any weakness is not expected to last long.