Chicago Board of Trade Market News

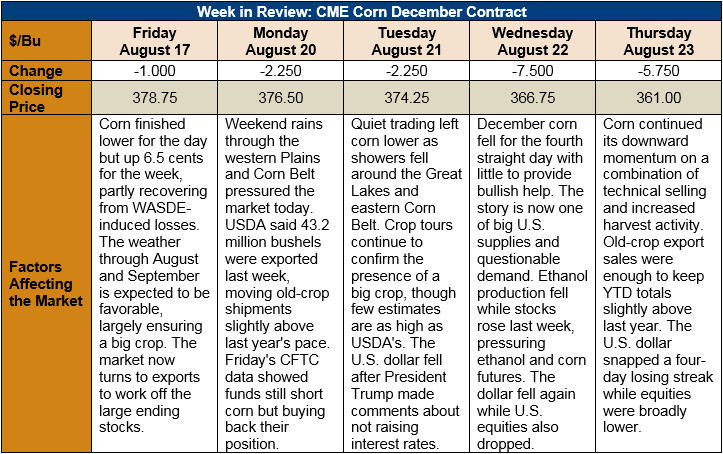

Outlook: December corn futures came under pressure this week from a combination of good U.S. weather, crop tours confirming above-trendline U.S. corn yields, and technical selling. December futures are down 18.75 cents from last week, a 4.9 percent drop. The bearish factors driving this week’s declines are expected to remain in effect for the near-future, though life-of-contract-low support is only 11 cents away.

USDA surprised the market with its 11.204 MT/Ha. (178.5 bushel per acre) yield estimate, though other crop tour yield estimates have since confirmed well-above trendline yields. The Pro Farmer tour estimated Iowa and Illinois yields well above last year and the average yield for each state, though recent findings suggest Minnesota yields could miss the average mark. Few private estimates peg the U.S. yield as high as USDA, but it’s important to note that USDA’s August WASDE forecast had a 90 percent confidence interval of 11 percent either way. In any case, field reports are confirming large yields and U.S. supplies, and the market is adjusting accordingly.

USDA’s Export Sales report featured old-crop corn net sales of 173 KMT this week and exports of 1.313 MMT. YTD exports are up 2 percent from last year while YTD bookings (exports plus unshipped sales) are up 7 percent. Given this, the U.S. will likely rollover a moderate volume of unshipped sales from 2017/18 to 2018/19. New-crop outstanding sales are already up 60 percent versus last year. Other highlights from the report include a 7 percent YTD increase in sorghum exports and a 56 percent increase in barley exports.

Good weather and timely showers across the Midwest are keeping the U.S. corn crop in good shape. USDA reported 68 percent of the U.S. crop is rated good/excellent, equal to the five-year average. USDA also reported the share of the crop in dent stage is 44 percent, up from 26 percent on average.

From a technical standpoint, December corn broke through downside support on Wednesday and continued the trend Thursday, ushering in a more bearish outlook. Futures are oversold but funds’ relatively small short position in the market suggests more selling would not be hard to obtain. Additionally, basis is falling across much of the Corn Belt, erasing another potential support element. For now, the trend is lower but the life-of-contract low at 350 ¼ will provide significant support. Whether bears will find enough reasoning to justify selling below this point remains to be seen.