Chicago Board of Trade Market News

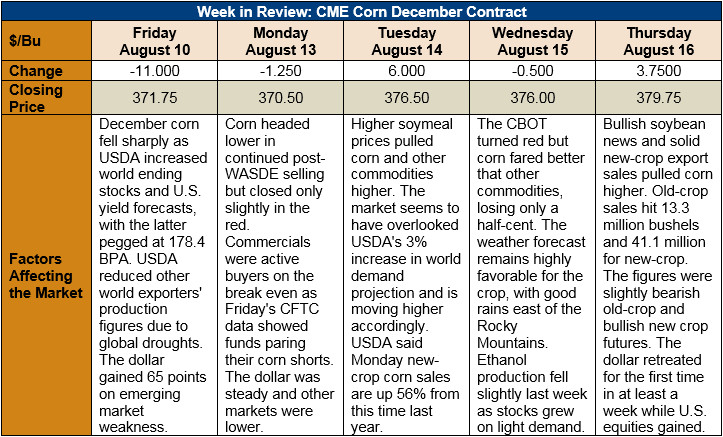

Outlook: December corn futures dropped 11 cents/bushel following Friday’s August WASDE, but have since recovered all but 3 cents of that loss. The WASDE’s initial bearishness came from record U.S. yield estimates and the consequent increase in U.S ending stocks. The recent recovery in corn futures, however, appears to be driven by perceptions of a tightening global supply situation.

The August WASDE shocked most market participants with a record-breaking U.S. corn yield of 11.204 MT/ha. (178.4 bushels/acre). Most analysts predicted yields near 174 bushels/acre, given the somewhat spotty growing conditions across the U.S. USDA’s forecast, however, proved the efficiency of modern farming along with the overall excellent growing conditions dealt to U.S. corn this year. The U.S. crop is well-advanced in its maturity, with double the typical share of corn entering the dent stage this week.

Other key figures from the August WASDE include a 5.6 percent increase in 2018/19 U.S. corn exports (to 60.963 MMT or 2.4 billion bushels) and a 1.5 percent increase in U.S. ending stocks. The final 2018/19 ending-stocks-to-use ratio came in at 11.2 percent, prompting USDA to decrease its farm-gate price forecast $0.20/bushel to $3.60.

USDA increased 2018/19 world corn ending stocks to 155.5 MMT, up 2.3 percent from the Agency’s July projections, despite a 1.2 percent in world exports. The USDA pegged 2018/19 world ending-stocks-to-use at 12.4 percent, up 0.2 percent from August but down from 15.9 percent in 2017/18. The former statistic highlights the tightening world supplies that are partly responsible for pulling corn prices higher.

Other surprises from USDA’s WASDE were a reduction in Brazil’s 2018/19 corn production forecast and a 3 percent increase in production from Ukraine, along with a 2 percent increase in exports from the latter country. The USDA decreased the EU’s corn production forecast 3 percent to 59.8 MMT and left the balance sheets for China and Mexico unchanged.

The weekly Export Sales report from USDA showed 339,000 MT of net sales for 2017/18 and 1.22 MMT of shipments. YTD exports are up 1 percent from 2016/17 volumes while YTD bookings (exports plus sales) are up 7 percent. The report also featured YTD sorghum exports that are up 7 percent and a 75 percent YTD increase in barley exports. Tightening global feed grain supplies are partly responsible for the uptick in U.S. exports.

From a technical perspective, December corn pulled back from overbought conditions that preceded the August WASDE, found support early this week and moved higher. The 20-day moving average seems to be providing key support for the market in the near-term. Resistance lies at $3.90 with the 100- and 200-day moving averages shortly above that. To move substantially higher, corn needs fundamental justification to breach these points. It is possible the July 12 and August 13 daily lows are forming the beginnings of an uptrend in the market. Declining trading volume makes the strength of this development somewhat suspect, however. For the near term, choppy, sideways trading is expected until more fundamental information is uncovered.