Chicago Board of Trade Market News

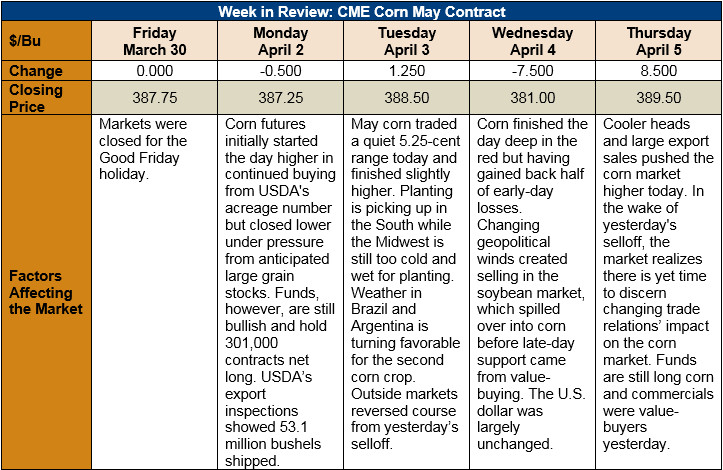

Outlook: Since the USDA surprised the market with a lower-than-expected acreage number last Thursday, the corn market has remained volatile. On Wednesday, geopolitical announcements triggered massive selling in the soybean market, which spilled over into corn futures as well. May corn futures fell 16 cents early Wednesday morning before paring losses back to roughly half that figure. Thursday’s trading, however, brought prices back to pre-selloff levels as traders focused again on the fundamentals.

USDA’s Export Sales report this morning continued the trend of this marketing year: big sales recorded against exports that fell shy of the pace needed to meet USDA’s target. Weekly net sales totaled 898,000 MT while exports were 1.265 MMT, less than the 1.4 MMT needed this week to keep pace with USDA’s 56.5-MMT-forecast. Corn bookings (exports plus unshipped sales) are 83 percent of USDA’s forecast while exports have only reached 43 percent. Typically, the U.S. has exported 52 percent of its marketing year total by this point in the year.

America’s new-crop corn is off to a slow and below-optimal start so far. Planting in the South is progressing at a normal rate, with Texas, Mississippi, and Arkansas planting 55 percent, 50 percent, and 24 percent of their respective crops so far. However, the Midwest has yet to start planting and 95 percent of the Upper Midwest still has snow cover. Consequently, the odds for a late planting for this year’s corn crop are increasing. Combined with drought in the Southern Plains, the corn crop seems to be facing a rough start even though seeding has not yet begun.

Technically, old-crop corn (May and July futures) is trending sideways while new-crop corn (December futures) is trending higher. The later contract is testing resistance at $4.15/bushel and has support from moving averages and momentum indicators. The former is range-bound with $3.90 as strong resistance and the 100-day moving average as support. Funds are still net-long corn though Wednesday’s selloff likely reduced their position somewhat. Choppy trading is likely to persist in old-crop futures while new-crop prices could slowly grind their way higher.