Chicago Board of Trade Market News

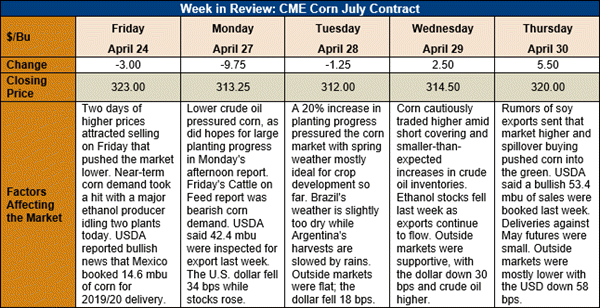

Outlook: July corn futures are 3 cents (0.9 percent) lower this week after heavy fund selling early in the week found short-covering support on Thursday. Thursday’s rally on the soy complex also triggered spillover buying in the corn market. U.S. exports have picked up with prices nearing multi-year lows and the outlook for improved export shipments is helping keep the corn market supported.

The weekly Export Sales report was neutral/bullish the corn market with 1.54 MMT of gross corn sales and 1.356 MMT of net sales reported this week. The net sales figure was up 87 percent from the past week as the U.S. dollar has retreated from recent highs. The weekly export figure rose 27 percent to 1.051 MMT. YTD exports now stand at 22.7 MMT, down 55 percent from a year ago while YTD bookings (exports plus unshipped sales) stand at 36.75 MMT, down 20 percent.

Cash corn values are lower across the U.S. this week with the average basis level dropping 7 cents to average 40 cents under July futures (-40N) this week. Basis levels are now in-line with their five-year average values as commercial buyers remain patient but aggressive on market dips. Barge CIF NOLA values are slightly lower this week while FOB NOLA offers are down 2 percent at $145.25/MT for spot shipment.

Sorghum prices have jumped another 40 cents/bushel this week, reaching levels of 240 cents over July futures (240N) for June shipment. China, Japan, and Mexico remain aggressive buyers, securing over 220,000 MT last week.

From a technical standpoint, July corn futures tested contract low support on Wednesday and uncovered substantial short covering and commercial buying interest. The heavy trading volumes that have occurred when the contract has set/approached its contract lows suggests that point ($3.09) is a major support point going forward. The market attempted a rally above the 10-day moving average on Thursday but closed just shy of that value. With exports and commercial pricing activity remaining active and increasing odds that a seasonal, bullish weather event will develop, it looks like the corn market lows have been set.