Chicago Board of Trade Market News

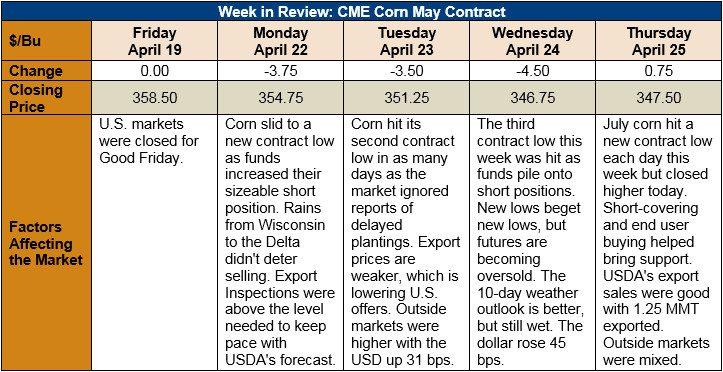

Outlook: May corn futures are 11 cents (3.1 percent) lower than last Thursday’s close as fund selling and weak technical indicators pressured the market. With May futures hitting new contract lows today, there was active short-covering along with some new longs being created. That helped lift prices off daily lows, but stiff resistance was found at $3.51. With a less-than-favorable weather outlook for the U.S., the market may try to rally, but there is presently little other news to fuel a move higher.

The main concern for the 2019 U.S. corn crop is the wet weather persisting across the Western Corn Belt and the Delta regions. The forecast includes above-average precipitation for these locations, which may work to delay planting. Per the USDA’s latest Crop Progress report, 6 percent of the U.S. crop was planted as of April 21st, behind the five-year average pace of 12 percent. The good news is that U.S. farmers have proven time and again that they can get an amazing number of acres planted in a very short window, if provided with the latter.

USDA’s weekly Export Sales report featured net sales of 779 KMT and weekly exports of 1.25 MMT. The export figure was up 2 percent from the prior week and is keeping YTD exports up 14 percent. YTD bookings, however, are down 9 percent, which is slightly below USDA’s anticipated yearly decrease in exports of 6 percent. Other Export Sales highlights include 92.4 KMT of sorghum exports and 1,000 MT of barley exports. Barley exports are up 49 percent YTD.

U.S. cash corn prices are slightly lower this week in sympathy with CBOT values. The average U.S. price reached $3.27/bushel this week, down 3 percent from the prior week and down 9 percent from this time last year. Farmer selling, however, has been light.

From a technical standpoint, May and July corn futures are in a weak pattern that has left them forging new contract lows. Today’s price action, however, offers interesting developments as the contract lows were met with short-covering and some commercial buying, which pulled the contracts higher at the close. While daily highs were insufficient to form a “key reversal” chart pattern, they do hint that there is growing nervousness on the part of short-position holders. With the most notable fundamental factor in the U.S. (delayed planting) being bullish, it would be unsurprising to see today’s support evolve into a rally – especially considering that corn is technically oversold.