Chicago Board of Trade Market News

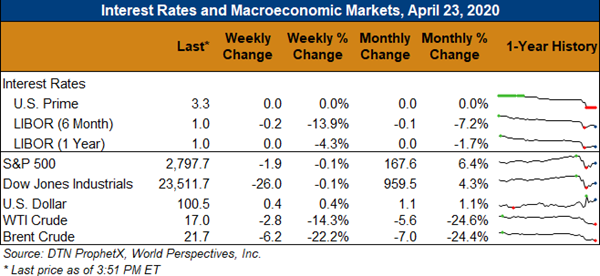

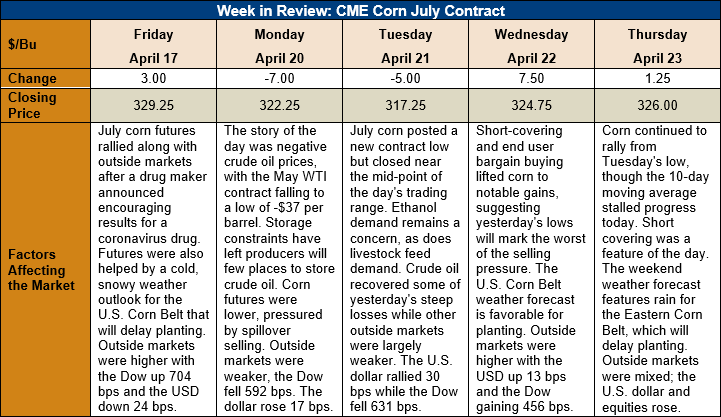

Outlook: July corn futures are 3 ¼ cents (1 percent) lower this week after heavy fund selling early in the week found short-covering support on Wednesday and Thursday. Tuesday’s trade had the feeling of a “blow off” bottom with prices posting a new contract low early in the day but trading higher into the close. Fundamental news remains light, but traders are closely watching the Midwest weather. Corn futures tend to have weather-driven rallies in May, and traders are hesitant to remain overly short with that seasonal trend approaching.

The weekly Export Sales report was neutral the corn market with 1772 KMT of gross corn sales and 726 KMT of net sales reported this week. The net sales figure was down from the past two weeks due to a stronger U.S. dollar. The weekly export figure dipped to 830 KMT, down from last week’s marketing year high. YTD exports now stand at 21.6 MMT, down 35 percent from a year ago while YTD bookings (exports plus unshipped sales) stand at 35.4 MMT, down 22 percent.

Cash corn values are lower across the U.S. this week with the average basis level dropping 2 cents to average 35 cents under July futures (-35N) this week. Reductions in industrial corn consumption have allowed basis levels to widen to their five-year average levels after posting multi-year highs earlier this spring. Barge CIF NOLA values are slightly lower this week while FOB NOLA offers are down 2 percent.

Sorghum prices have jumped higher again this week, reaching levels of 200 cents over May futures (200K) for last-half May shipment. June exports are offered at 200 cents over July futures (200N) FOB NOLA. China remains an aggressive buyer, securing 134 KMT last week, with Mexico also booking product.

From a technical standpoint, July corn futures look to have found their near-term lows on Tuesday and have mounted a notable 17-cent rally from Tuesday’s low. The 10-day moving average stalled Thursday’s rally, but the market is likely to close above that point if short-covering and commercial bargain buying continue. Futures had become technically oversold and were ripe for a corrective move higher. Funds hold a sizeable short position in the corn market, which will increasingly be viewed as a liability with seasonal weather-driven rallies likely to appear this spring.