Chicago Board of Trade Market News

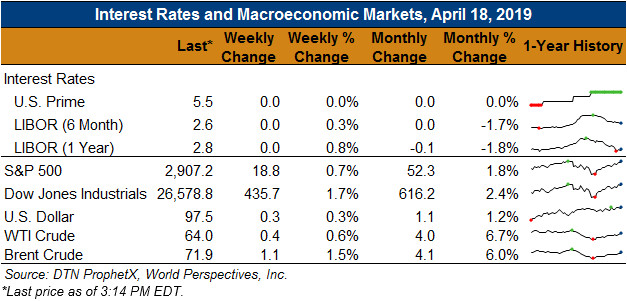

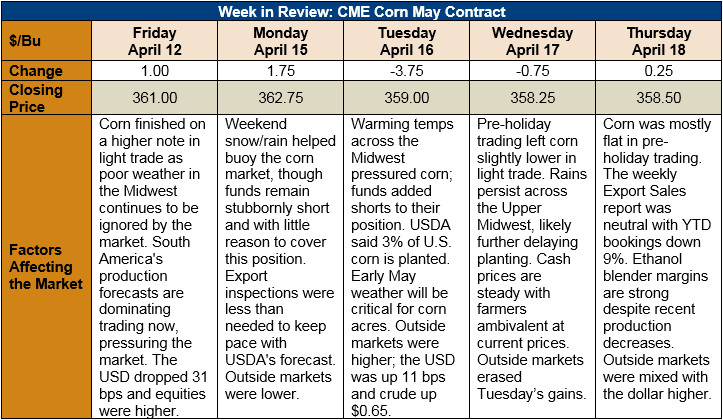

Outlook: May corn futures are 2.5 cents (0.7 percent) lower than last Friday’s close as fundamental news remains light amid a weak technical picture. The biggest factors driving the market presently are the cool, wet weather across the Upper Midwest, the pace of U.S. exports, and the large short position held by managed money funds. With potentially bullish factors (i.e., a significant shift in acreage) yet to be confirmed, the market looks largely relegated to continue its recent sideways trading pattern.

USDA reported Monday that 3 percent of the U.S. corn crop was planted, down from the five-year average pace of 5 percent. Planting so far has been dogged by persistently cold, wet weather across the Midwest – especially the Upper Midwest. While the situation is likely not yet sufficient to significantly delay planting or create a big acreage shift, it places far more importance on the weather in early May. Should the present weather pattern persist into that time period, it may significantly impact plantings and create a more bullish supply situation for the U.S.

USDA’s weekly Export Sales report featured 1.03 MMT of net corn sales and exports of 1.22 MMT. The export figure was up 25 percent from the prior week and sufficient to keep YTD exports up 16 percent. YTD bookings (unshipped sales plus exports) are down 9 percent at 44.6 MMT. Other highlights from the report were 22.2 KMT of sorghum shipments and 1.3 KMT of barley exports. Barley exports are up 28 percent YTD.

U.S. cash corn prices are steady with last week and down slightly (2 percent) from this time last year. Barge rates continue to work their way lower while FOB Gulf prices have stabilized. Consequently, elevation margins are improving and, with U.S. corn’s competitiveness on the world market, exports are likely to continue rising.

From a technical standpoint, May corn remains under pressure from downward-sloping moving averages and from the massive short position held by managed money funds. Funds have largely completed the process of rolling their positions from the May contact to July, which will allow May futures to start to converge with cash prices. Currently, futures are 20 cents above the U.S.-average cash price ($3.38/bushel). The positive factor for the corn market is that support near the contract lows has held with active commercial buying. With the odds increasing of a late-planted U.S. corn crop, and a likely shift of corn acres to soybeans, the supply situation for corn could be tightening. The futures market has yet to generate a reversal signal, but when it does the convergence of poor weather and short positions could create a sharp move higher.