Chicago Board of Trade Market News

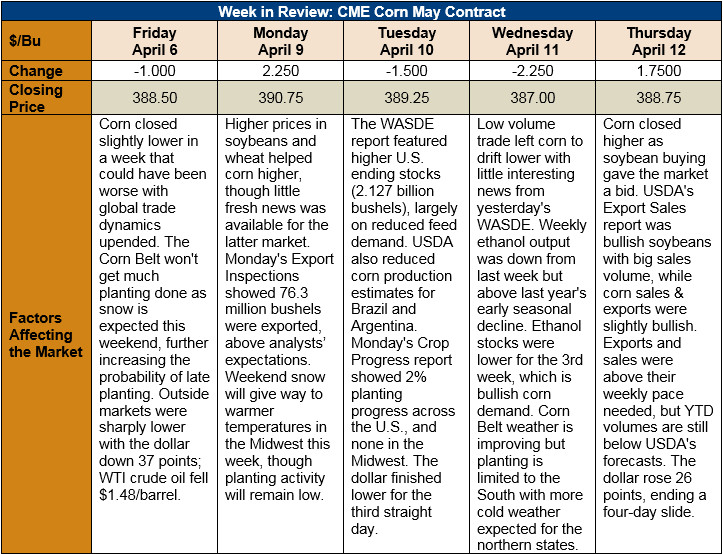

Outlook: Following last week’s policy-heavy week, this week has featured a calmer tone for the corn market. The biggest factors have been the relatively benign WASDE report on Tuesday and today’s Export Sales report. The market is switching to demand-watching mode while it waits for plantings (2 percent complete as of last week) to pick up in the Midwest.

The WASDE’s biggest change to the U.S. corn balance sheet was a 1.27 MMT reduction in feed and residual use that carried through (combined with a 127,000 MT reduction in FSI use) to boost 2017/18 ending stocks by 1.379 MMT to 55.426 MMT. USDA left the mid-point of its farm-gate price forecast unchanged, however, at $3.20/bushel.

As the trade expected, USDA lowered corn production forecasts for Brazil and Argentina, trimming the former’s production prospects 2.5 MMT to 92 MMT and the latter country’s production 3 MMT to 33 MMT. Argentina has suffered a massive drought this year and the production changes were within the market’s expectations. Notably, USDA reduced Argentine ending stocks 1.3 MMT, which equates to a 3 percent change in ending stocks/use. This is a sizeable shift in the stocks/use level and domestic prices could tighten accordingly.

The USDA made only minor changes to the U.S. sorghum and barley balance sheets this month. Feed and residual use of sorghum was pared 127,000 MT and ending stocks were reduced a commensurate amount. USDA increased the bottom end of its farm-gate sorghum price 10 cents/bushel. This month’s WASDE also saw minor reductions in barley and oats import figures, as well as a 77,000 MT reduction in oat feed use. Barley price forecasts were increased slightly while oat prices were reduced.

This week’s export sales report featured 0.839 MMT of 2017/18 corn sales and 1.91 MMT of corn exports (a marketing-year high). YTD bookings (sales plus exports) are down so far while YTD exports are down as well. If the U.S. ships all its bookings, the final 2017/18 export figure could be much closer to USDA’s projections than present exports suggest. Weekly sorghum exports totaled 197,000 MT, bringing YTD bookings to a 29-percent increase while barley exports totaled 1,200 MT, bringing YTD bookings to 157 percent of last year.

From a technical standpoint, May corn futures are in a sideways trading pattern with resistance at $3.92/bushel and support at $3.80. Exports are the biggest factor left to influence old-crop markets and other demand (feed and ethanol) will be closely watched as well. Funds are still long corn and likely won’t relinquish this position unless exports are threatened again. For now, choppy sideways trading is the most likely outcome for the market.