Chicago Board of Trade Market News

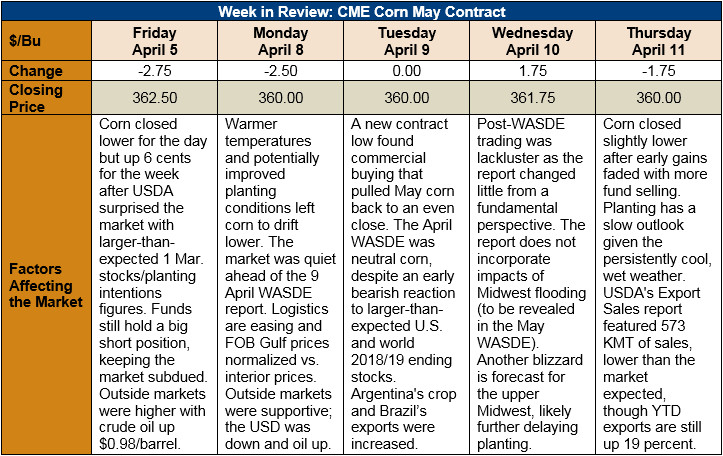

Outlook: May corn futures are 2.5 cents (0.7 percent) lower this week after recovering from Tuesday’s WASDE-induced contract low. Traders initially interpreted the report’s increase of U.S. and world ending stocks as a bearish signal and pushed the May contract lower. Ultimately, however, the report was interpreted as neutral the corn market as nearly all USDA’s changes were anticipated in some form by the market.

The impacts of larger South American crops and U.S. corn stocks were felt in the April WASDE. USDA increased world 2018/19 corn ending stocks 1.8 percent versus its March estimate, with 314 MMT as its latest figure. World corn production was up slightly (0.6 percent) based largely upon a 2 percent upward revision in Argentina’s corn crop. USDA also increased its estimate of Argentine corn exports for 2018/19 to 30.5 MMT and issued a 7 percent increase in Brazil’s corn exports for 2018/19. Brazil’s corn export forecast now stands at 31 MMT, based on favorable weather conditions and production outlooks for the safrinha corn crop.

The 2018/19 U.S. corn balance sheet, as projected by the April WASDE, features 2018/19 ending stocks that are 11 percent higher than USDA’s March estimate. The additional carry-out came after UDSA made reductions to its U.S. ethanol use forecast, lowered feed and residual use by 1.4 percent, and dropped the export forecast 3.2 percent. Those adjustments added 5.08 MMT (200 mln. bu.) to the 2018/19 carry-out forecast; USDA projects the average farm price for the 2018/19 crop year will be $139.76/MT ($3.55/bu.). Elsewhere in the WASDE, USDA increased 2018/19 sorghum feed and residual use by 127 KMT (5 mln. bu.) and lowered ending stocks estimate the same amount.

USDA’s weekly Export Sales report featured 548 KMT of net corn sales and exports of 983 KMT. The export figure was down from the prior week but was sufficient to keep YTD exports up 19 percent. YTD bookings (unshipped sales plus exports) are down 9 percent at 43.7 MMT. Other highlights from the report were 3.3 KMT of sorghum shipments and 1.2 KMT of barley exports. Barley exports are up 49 percent YTD. U.S. cash corn prices are steady with last week and down (-4 percent) from this time in 2018. FOB Gulf values are normalizing against interior prices; this could allow export sales/shipments to increase in the near-term.

From a technical standpoint, May corn looks to have formed a double-bottom chart formation with support at $3.55. With funds holding a big short position in the corn market, prices are unlikely to rally in the near-term. Rather, choppy sideways trade is likely. One positive for the market is that commercial buying has been aggressive on dips, which is keeping the market supported. Moreover, with good odds that USDA will lower its forecast of 2019 U.S. corn planted acres in May’s reports, there should be fundamental support coming soon.