Ethanol, Fuels and Co-Product Pricing

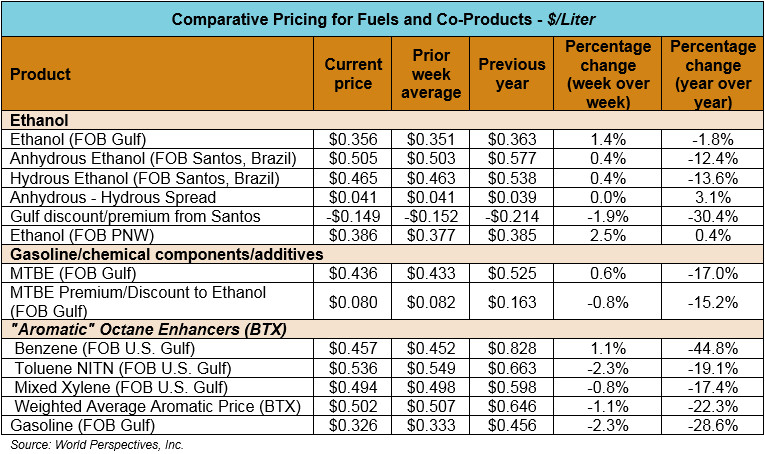

Market Outlook: U.S. ethanol prices ended last week up 1 percent and continue slightly up through Wednesday amid a continued period of muted trading activity. Midwest wholesale rack ethanol prices were up 0.5 percent to end last week; they are up 0.7 percent to start this week with prices at 37.61 cents/liter (142.38 cents/gallon) through Wednesday’s trading.

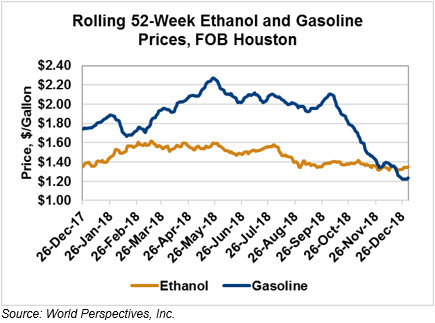

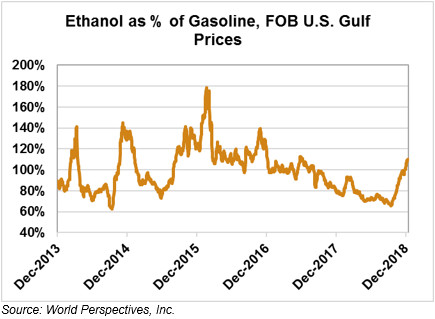

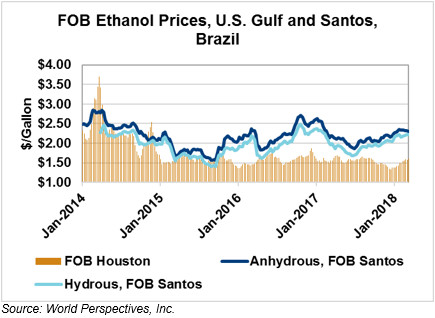

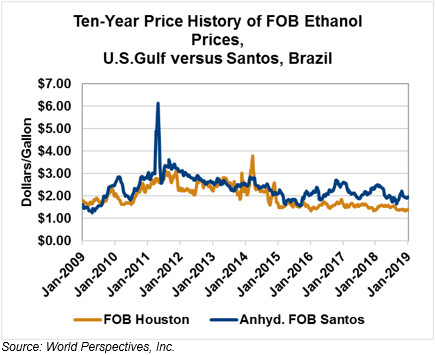

FOB Houston ethanol prices finished last week slightly down; prices are up through Wednesday’s trading (1.4 percent) from Friday’s close. FOB Houston ethanol prices are quoted at 35.607 cents/liter (134.788 cents/gallon). FOB Santos, Brazil ethanol prices ended last week down nearly 1 percent; prices are up slightly from Friday’s close and stand at 50.530 cents/liter (191.275 cents/gallon) through Wednesday’s trading.

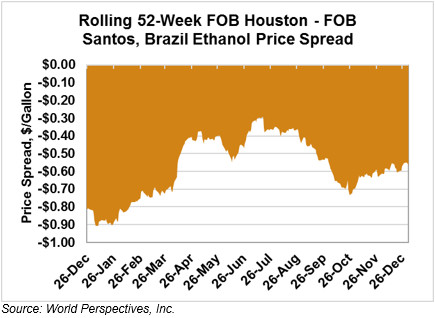

The FOB Gulf-Santos, Brazil spread narrowed from last week’s close through Wednesday’s trading and is currently at -14.922 cents/liter (-56.488 cents/gallon).

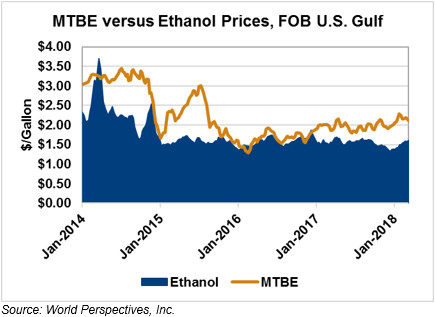

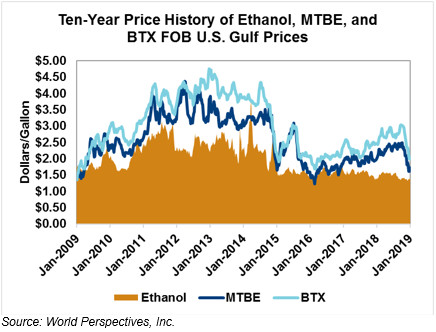

MTBE prices were down over 7 percent to end last week but are unchanged through this week’s trading. MTBE’s premium to FOB Houston ethanol stands at 7.719 cents/liter (29.22 cents/gallon).

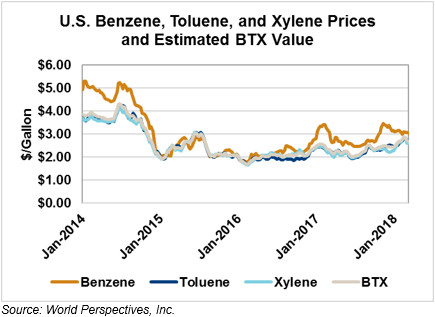

BTX component prices were down to end last week and are mixed through Wednesday’s trading, with Benzene prices up 0.9 percent, Toluene prices down 2 percent and Xylene prices down 1.1 percent. The estimated weighted average aromatic price is currently 50.13 cents/liter (189.74 cents/gallon), down 1.2 percent from last Friday’s close. The BTX-Houston ethanol spread narrowed this week; the weighted average BTX price remains 14.518 cents/liter (54.96 cents/gallon) higher than the FOB Houston ethanol price.

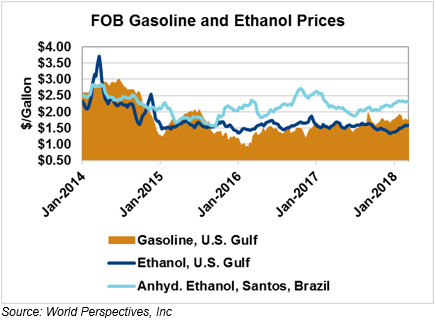

Gasoline and petroleum products were mixed to end last week amid continued supply considerations. This week, RBOB futures are up; 84 (Houston) and 87 (U.S. Gulf) octane gasoline prices are both up 3 percent. WTI futures are up 4.3 percent to $47.26/barrel, and Brent futures are up 5.3 percent at $56.01/barrel from Friday’s close through Wednesday’s trading.

Price Database: If you are interested in historical price data, please click here.