1. Ethanol, Fuels and Co-Product Pricing

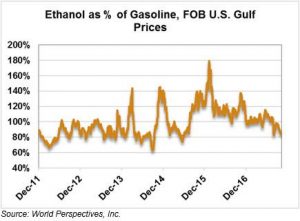

Market Outlook: CBOT ethanol futures are lower Tuesday on a pullback from the sharp rally last week and Monday. The nearby CBOT contract is 0.98 cents/liter (3.7 cents/gallon) higher this week than last as global petroleum markets rallied. The CBOT corn market, typically a leading indicator for ethanol futures, has been remarkably quiet in recent weeks and the ethanol market is starting to trade news beyond corn. Cash ethanol prices are rising in sympathy with other energy markets too, and the national spot rack price increased 1.7 percent (0.69 cents/liter or 2.6 cents/gallon) this week to its last quote of 41.24 cents/liter (156.47 cents/gallon).

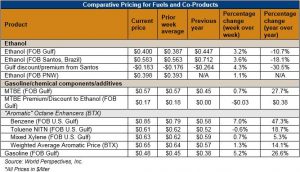

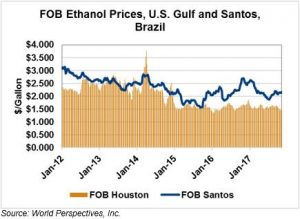

FOB Houston ethanol prices rose 1.7 percent this week to 39.956 cents/liter (151.25 cents/gallon). Sharper gains were seen in Brazil’s FOB Santos market, where prices rose 2.7 percent to 58.303 cents/liter (220.7 cents/gallon). The rising market action widened the spread between U.S.- and Brazil-origin ethanol, which reached -18.347 cents/liter (-69.45 cents/gallon) as of its last quote. The spread is 4.8 percent wider than this time last week and is at a new six-month low.

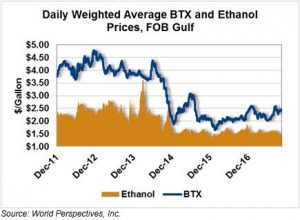

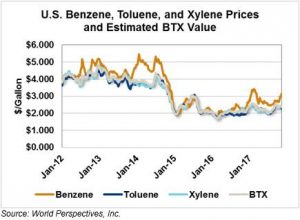

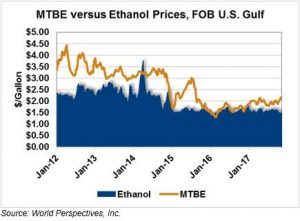

MTBE prices are higher again this week and narrowly set a new six-month record high. MTBE prices rose 0.5 percent, or 0.26 cents/liter (0.98 cents/gallon) to end at 57.06 cents/liter ($2.16/gallon). BTX component prices were also higher with Benzene prices gaining 2.2 percent and Toluene and Xylene prices each gaining 1.3 percent, respectively. The weighted average aromatic price is currently estimated at 64.3 cents/liter ($2.43/gallon), up 1.4 percent from last week. The weighted average BTX price is 24.06 cents/liter (91.1 cents/gallon) higher than FOB Houston ethanol prices and MTBE FOB Gulf is 18.5 cents/liter (70.24 cents/gallon) higher than U.S.-origin ethanol.

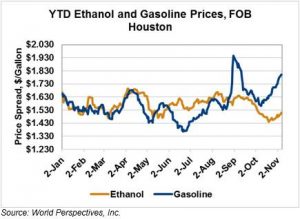

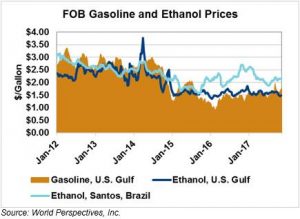

Gasoline prices are sharply higher this week, driven by crude oil prices rising on macroeconomic news; news of the shake-up in Saudi Arabia and another weekly draw-down in U.S. crude oil stocks have given significant strength to the crude oil/gasoline complex. RBOB futures are up 2.27 cents/liter (8.6 cents/gallon) this week while 83.7 octane RBOB gasoline and 87 octane RBOB FOB Houston each increased 2.93 cents/liter (11.1 cents/gallon) this week. WTI and Brent crude oil futures are 5.1 percent and 4.4 percent higher this week, last quoted at $57.20 and $63.65/barrel, respectively.

Price Database: If you are interested in historical price data, please click here.