1. Ethanol, Fuels and Co-Product Pricing

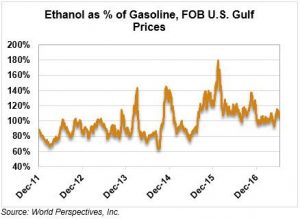

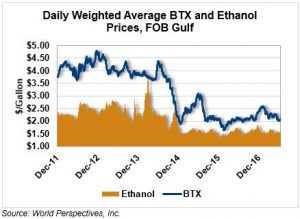

Market outlook: Ethanol prices have been broadly higher this week, with both spot and futures prices gaining. Corn prices were sharply higher before Wednesday’s trading session which buoyed ethanol prices. However, the post-WASDE selloff in the corn market will pressure ethanol prices going forward.

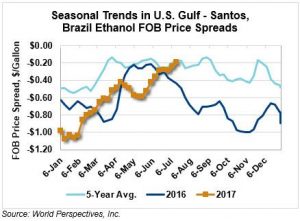

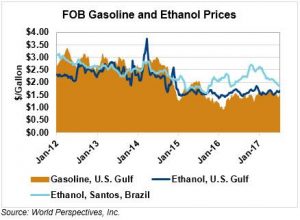

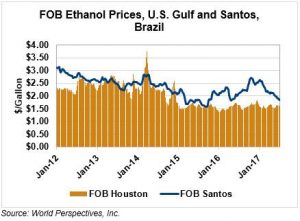

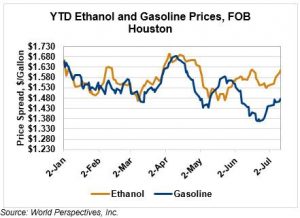

FOB Houston ethanol prices increased $0.02 per gallon this week to $1.602 as gasoline and corn prices supported the market. Brazilian ethanol (FOB Santos) underwent a large increase, gaining $0.028/gallon to $1.894. FOB U.S. gulf gasoline prices were 1-2 cents higher this week as well.

The rise in corn prices did not favor ethanol producer margins. Returns over operation costs for the typical dry-mill plant fell 11.07 cents to 17.67 cents/gallon this week – the lowest since mid-May. The squeeze on margins helped keep ethanol production nearly flat this week and will likely restrict supply growth for the coming week.

Additional ethanol production capacity may soon be coming online in the southern U.S. Alliance Bio-Products Inc. recently received approval from the USDA’s Office of Rural Development to purchase a shuttered ethanol plant Vero Beach, FL. The plant has an annual capacity of 8 million gallons and Alliance plans to begin production “by summer of 2018”. Past that, the company will look to double the plant’s capacity to 16 million gallons by 202 and eventually expand to 34 million gallons per year in 2023.

Changes in Mexico’s ethanol policy may boost U.S.-Mexico delivery of E10 gasoline. In June, industry news sources announced that Mexico will accommodate 10 percent ethanol-blended gasoline. Previously, Mexico’s policies create a situation where only one firm would import 5.8 percent ethanol-blended gasoline from the U.S. Mexico’s move to accommodate E10 gasoline will likely boost the country’s imports from the U.S. and help build U.S. ethanol demand. Another factor which will likely boost U.S. exports of E10 gasoline is Mexico’s shortage of storage tanks for ethanol, a problem particularly pronounced in the southern portions of the country. Lack of storage space for blending ethanol may increase demand for ethanol-blended gasoline, rather than the two components individually.

Elsewhere in U.S. export markets, Brazil’s imports of U.S. ethanol remained robust in June. The South American country imported 199,460 cubic meters of ethanol from the U.S., down from 247,955 in May but enough to put first-half 2017 imports more than four times larger than in 2016. Brazil’s Chamber of Foreign Trade (CAMEX) recently postponed a decision on a potential tariff of up to 17 percent on ethanol imports. CAMEX is expected to meet and decide on the tariff later in July.

Price Database: If you are interested in historical price data, please click here.