Ethanol, Fuels and Co-Product Pricing

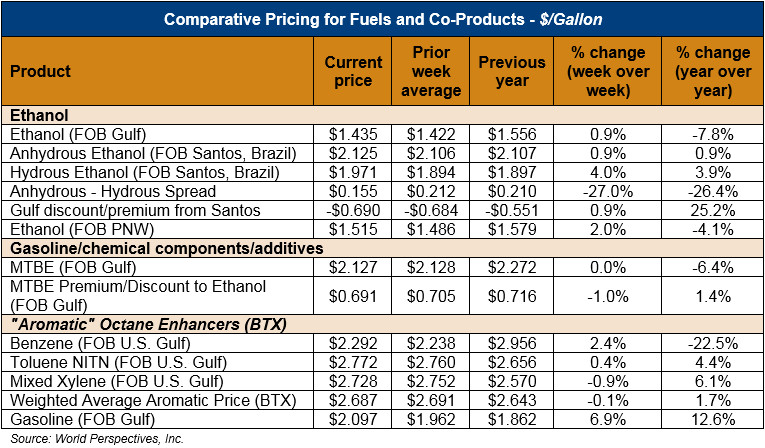

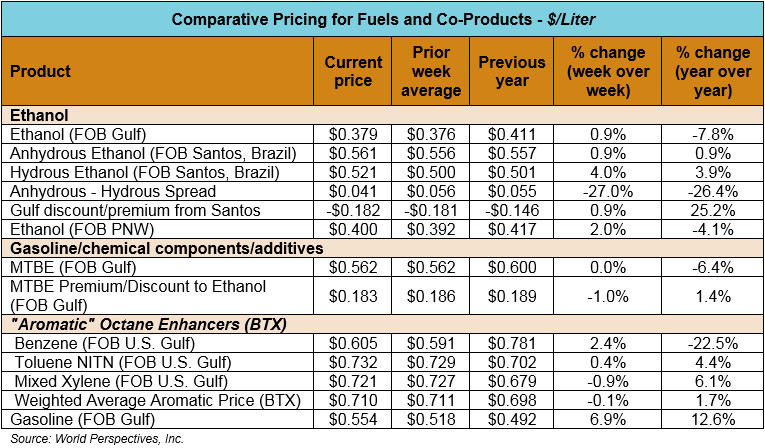

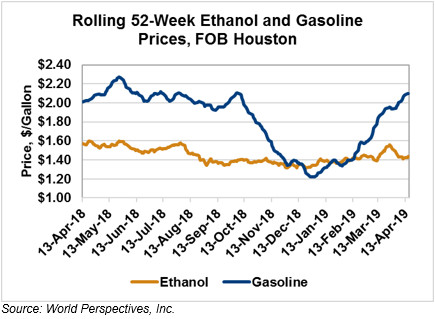

Market Outlook: U.S. ethanol prices ended last week up 1.1 percent but are down slightly (-0.4 percent) in early week trading. Midwest wholesale rack ethanol prices were unchanged to end last week; they are mostly unchanged this week at 38.62 cents/liter (146.21 cents/gallon) through Tuesday’s trading.

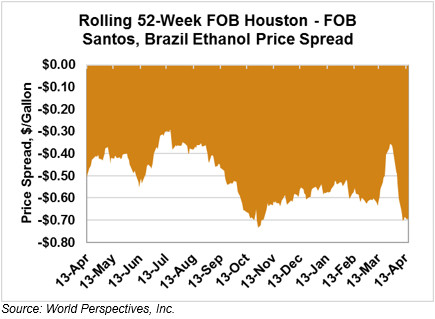

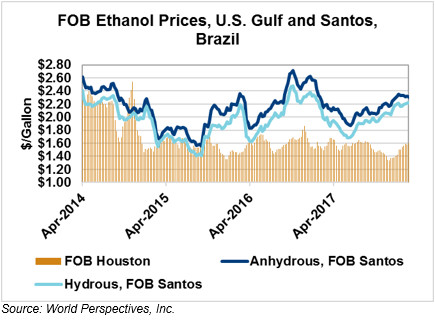

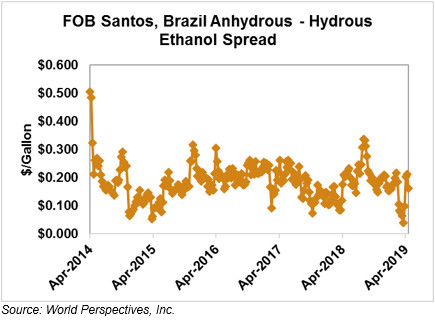

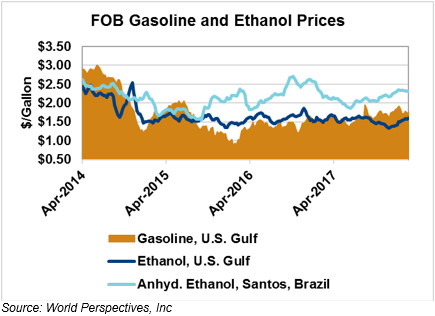

FOB Houston ethanol prices finished last week down 2.6 percent; prices are up nearly 1 percent through Tuesday’s trading from Friday’s close. FOB Houston ethanol prices are quoted at 37.91 cents/liter (143.53 cents/gallon). FOB Santos, Brazil ethanol prices ended last week up a significant 6.7 percent; they are up nearly 1 percent from Friday’s close and stand at 56.14 cents/liter (212.52 cents/gallon) through Tuesday’s trading.

The FOB Gulf-Santos, Brazil spread widened again from last week’s close through Tuesday’s trading and is currently at -18.22 cents/liter (-68.98 cents/gallon).

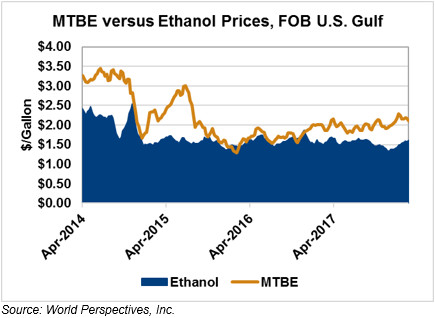

MTBE prices were up 1.8 percent to end last week; they are unchanged to start this week. MTBE’s premium to FOB Houston ethanol widened again from last week and now stands at 18.27 cents/liter (69.16 cents/gallon).

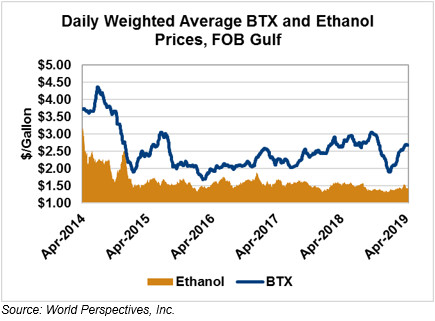

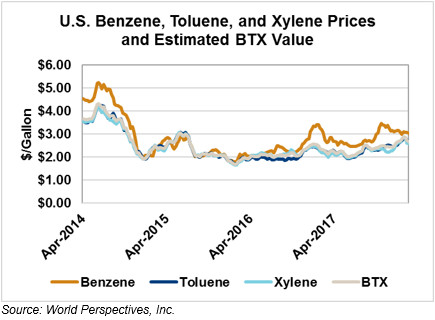

BTX component prices were mixed to end last week and remain so through Tuesday’s trading: Benzene is up 2.3 percent, Toluene is up 0.4 percent while Xylene is down 1.0 percent. The estimated weighted average aromatic price is currently 70.91 cents/liter (268.44 cents/gallon), down slightly from last Friday’s close. The BTX-Houston ethanol spread narrowed slightly from last week; the weighted average BTX price is 32.99 cents/liter (124.90 cents/gallon) higher than the FOB Houston ethanol price.

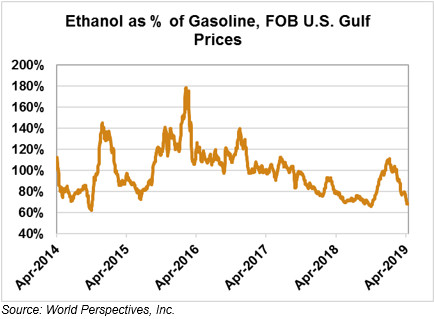

Gasoline and petroleum products were up to end last week and are mixed through early-week trading. In terms of RBOB futures, 84 (Houston) and 87 (U.S. Gulf) octane gasoline prices are down 0.3 percent and 1 percent, respectively. WTI futures are up half a percentage point to $64.20/barrel and Brent futures are up 0.3 percent to $71.78/barrel, from Friday’s close through Tuesday’s trading.

Price Database: If you are interested in historical price data, please click here.