Ethanol destined for industrial-use applications helped stabilize overall U.S. ethanol exports in April and May 2020 amid a bleak period for fuel demand globally.

The world’s fuel markets were dramatically disrupted early in the year as governments instituted movement restrictions and released social distancing guidelines to address the COVID-19 pandemic. Industrial end-use markets – including chemical, solvent and consumer products – were impacted to a lesser extent as the pandemic triggered a substantial uptick for sanitizing and disinfecting products that also use ethanol as an ingredient.

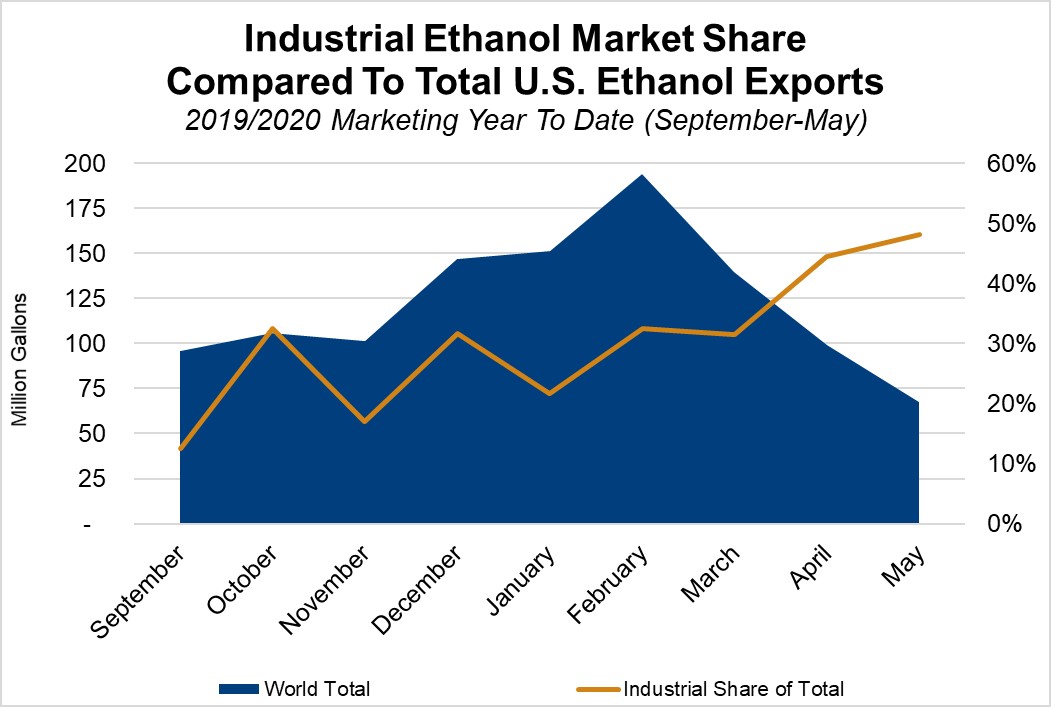

Industrial-use markets typically account for 25 percent of total U.S. ethanol exports, bought for uses like windshield wiper fluid in South Korea and the European Union or bioplastics in India. As fuel demand began to decline in March, industrial ethanol exports started to represent a larger proportion of the export mix and help support overall U.S. ethanol exports.

U.S. ethanol exports for industrial uses equated to approximately 50 percent of total exports in April and May, at roughly 44 million gallons (15.7 million bushels in corn equivalent) and 33 million gallons (11.7 million bushels in corn equivalent), respectively. The remaining half of exports continued to supply fuel markets. India, Nigeria and the Persian Gulf remained strong purchasers of U.S. ethanol for industrial uses, while increases in exports to South Korea and Mexico were notable.

While COVID-19 will likely negatively influence the global ethanol market through 2022, the U.S. Grains Council (USGC) continues to work to expand the global use of the renewable fuel.

The Council has maintained and even expanded programs in certain markets to ensure the pandemic does not translate to lost years on global ethanol policy implementation or emerging trends that could positively impact the U.S. ethanol industry.